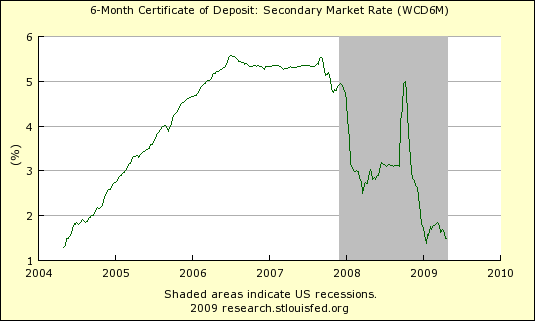

On the other hand, if you want to buy a certificate of deposit (CD) you might be shocked to learn that banks are lowering interest rates on six month certificates of deposit.

Nationally 6 month CD rates have fallen to 1.48 percent, down from 1.69 percent -- 3 weeks ago. A year ago six months CDs were running at 3.03 percent.

Bank interest rate margin spreads are widening all over the place. This is how banks make boat loads of money. They leverage up the interest rate curve to take advantage of the artificially low interest rates being create by the FED (a standard procedure by the FED in a recession). And, they gough (?) consumers coming and going.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

No comments:

Post a Comment