The head of the world's biggest bond fund, bemoaning the slow economic recovery, reignited debate Tuesday by publicly supporting a massive new refinance program currently roiling the mortgage bond market by describing it as a form of fiscal stimulus that wouldn't add to the deficit.

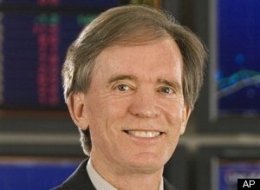

Bill Gross, who runs Pacific Investment Management Co.'s $239 billion Total Return Fund, said that policymakers "should quickly re-engineer" a plan that would refinance all non-delinquent mortgages backed by the federal government. The rate on a 30-year fixed-rate mortgage averaged a record-low 4.44 percent in the week ending Aug. 12, according to taxpayer-owned mortgage giant Freddie Mac.

Taxpayers guarantee the mortgages of 37 million households, or two-thirds of all homeowners with a mortgage, according to a July 29 note by David Greenlaw, Morgan Stanley's chief U.S. fixed-income economist. That includes government agencies like the Federal Housing Administration as well as twin behemoths Fannie Mae and Freddie Mac. Greenlaw estimates about 18.5 million taxpayer-backed mortgages are at rates higher than 5.75 percent interest.

By refinancing those mortgages at current, lower rates, Greenlaw believes those homeowners would save $46 billion a year. Gross said the refi scheme would spur some $50-60 billion a year in new consumer spending and raise home prices between 5-10 percent. Forecasters, including Fannie Mae, say home prices are set to decline the rest of the year and into 2011. Former Federal Reserve Chairman Alan Greenspan said this month that a so-called double-dip recession is possible "if home prices go down."

Source

Original content Bob DeMarco, All American Investor

No comments:

Post a Comment