Exxon Mobil (XON) is the largest publicly traded oil company.

The company produces approximately 2.4 million barrels of oil and 12.1 BCF of natural gas daily, has reserves of over 24.8 billion barrels of oil equivalents and manages a best in class upstream operation including refining and chemical operations.

XOM has grown profits at a pace in excess of 15% over the last 10 years and earned a return on equity of between 17-25%. While the pace of Exxon’s dividend growth has not kept pace with profits (7% over the past 10 years), it is expected rise. The financial performance of XOM should be solid over the coming years as a result of:

(1) its reserves are diversified geographically as well as by product [conventional oil and gas, heavy oil, tight gas, liquefied natural gas]; its recent acquisition of XTO Energy raises its share of the world energy market,

(2) substantial investment in its upstream operations. Importantly, it has successfully integrated its chemical business with its refining operations creating substantial operating efficiencies,

(3) the company has an exceptional balance sheet [it has a debt/equity ratio of 9% and has more cash than debt], has raised its dividend every year for the last 27 years and expects to invest $25 billion to $30 billion a year.

(4) ongoing cost control program.

Negatives:

(1) the most promising area for exploration are in politically risky areas,

(2) while the company has replaced its proved reserves, much of it comes from acquisitions versus organic growth,

(3) weak natural gas prices,

(4) it is subject to extensive government regulations,

(5) weather, especially in its offshore operations.

The company is rated A++ by Value Line, has a 5% debt to equity ratio and its stock yields 2.4%.

Statistical Summary

| Stock Yield | Dividend Growth Rate | Payout Ratio | # Increases Since 2002 | |

| XOM | 2.4% | 7% | 22% | 10 |

| IND | 3.6 | 6 | 31 | NA |

| Debt/Equity | ROE | EPS Down Since 2002 | Net Margin | Value Line Rating | |

| XOM | 5% | 22% | 1 | 9% | A++ |

| IND | 14 | 18 | NA | 7 | NA |

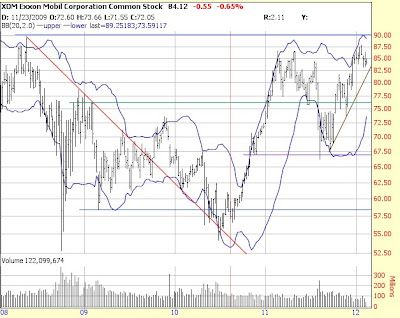

Chart

Note: XOM stock has struggled to make progress off its March 2009 low. While it quickly surpassed the down trend off its May 2008 high (red line), it has had mixed results challenging the November 2008 trading high (green line).

Long term the stock is in a trading range (straight blue lines). Intermediate term, it is also in a trading (lower boundary is the purple line, upper boundary is the same as the long term trading range). Very short term, XOM is in an up trend.

The wiggly blue lines are Bollinger Bands. The Dividend Growth Portfolio owns a full position in XOM; but this is a function of having repeatedly made Sell Half sales (i.e. the current size of this holding is $33,000 but the Dividend Growth Portfolio has taken $49,100 in profits in this position over time) and then letting this position re-grow to a full one.

The upper boundary of its Buy Value Range is $64; the lower boundary of its Sell Half position is $87.

http://finance.yahoo.com/q?s=XOM

No comments:

Post a Comment