The Market

Technical

Monday Morning Chartology

Friday the S&P traded through the ‘neckline’ of the reverse head and shoulders pattern---a technical positive. Absent a quick reversal today, the rough objective of this breakout is 1440.

**futures trading suggests that the S&P will fall back below that ‘neckline’. If we close the day that way then the ‘shoulder line’ (1292) is back in play.

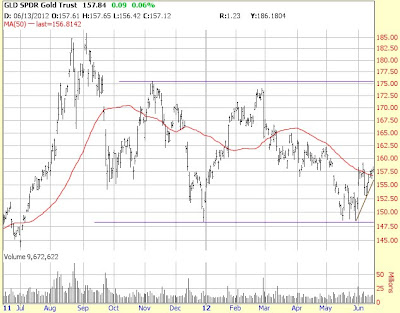

GLD has held the lower boundary of its intermediate term trading range quite well. It is also setting a very short term uptrend.

The VIX remains above the lower boundaries of its short term uptrend and its intermediate term trading range (a negative). However, note the developing head and shoulders formation which, if completed, would drive the VIX back to the 14-15 level.

Update on ‘the best stock market indicator ever’:

http://advisorperspectives.com/dshort/guest/John-Carlucci-Best-Indicator-Ever-Update.php

Fundamental

The Greek’s gave the pro-bail out party a victory. While that party must still form a government and then make proposals to the EU (Germany) for changes in the terms of the bail out, the ‘muddle through’ scenario remains alive and well and living in Europe. Meanwhile, investors aren’t so optimistic about Spain:

http://www.zerohedge.com/news/europhoria-fades-spanish-banks-may-need-whopping-%E2%82%AC150-billion-loan-loss-provisions

Politics

Domestic

Thoughts on the upcoming race for president (medium):

http://www.zerohedge.com/news/guest-post-does-america-face-election-between-two-moderates

Steve Cook received his education in investments from Harvard, where he earned an MBA, New York University, where he did post graduate work in economics and financial analysis and the CFA Institute, where he earned the Chartered Financial Analysts designation in 1973. His 40 years of investment experience includes institutional portfolio management at Scudder, Stevens and Clark and Bear Stearns. Steve's goal at Strategic Stock Investments is to help other investors build wealth and benefit from the investing lessons he learned the hard way.

No comments:

Post a Comment