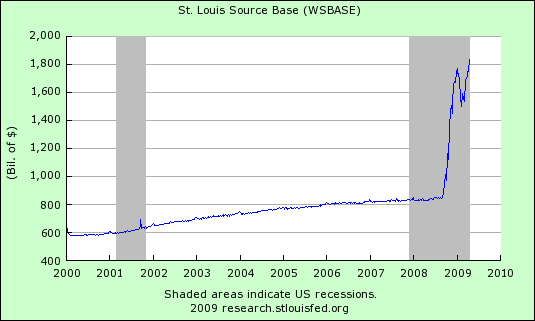

The biggest spike in the base started in October, 2008 in response to the growing financial crisis. From that perspective, we are only six months into this monster attempt at reinflation. A general rule of thumb says it takes 6 to 18 months to see the reaction from monetary inflation. We are entering the window now.

It is interesting that we are seeing all these deflationary numbers now. It reminded me of how inflation soared to over 1.5 percent a month in 1980. At that time, it appeared that the world was coming to an end. Paul Volcker stepped in and tightened, causing interest rates and inflation to came down fast. It also lead to the great bull market in stocks that started in 1982.

It is going to be interesting to see how high interest rates go when the Fed is forced to reverse field. A risky strategy for certain.

Note: Sum of currency in circulation, reserve balances with Federal Reserve Banks, and service-related adjustments to compensate for float. Calculated by the Federal Reserve Bank of St. Louis.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

No comments:

Post a Comment