Last week two popular measures of unemployment were reported: weekly unemployment claims (608,000) and the four week moving average of unemployment (615,750). Both showed that the number of people applying for unemployment insurance had dropped week over week.

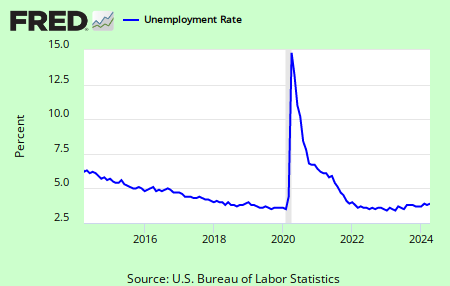

The previous week another popular measure of employment --the civilian unemployment rate--jumped to 9.4 percent from 8.9 percent.

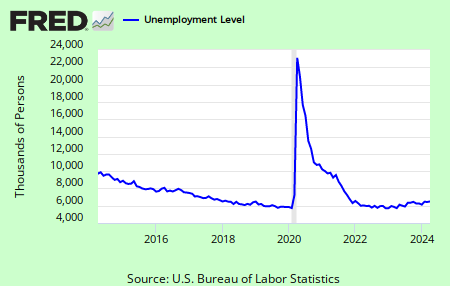

One number that is rarely reported in the popular media is the actual number of people that are unemployed. You might be shocked to learn that the number of unemployed workers soared to 14.5 million in the most recent report. This compares to 13.72 million the previous month, and 8.5 million a year earlier.

Source: The Employment Situation--Unemployed

While the more popular reports seem to be indicating that the employment situation is improving, the raw numbers show that more and more Americans are out of work. In fact, this is the largest number of unemployed since they started compiling this statistic in 1948.

Another sobering statistic is the number of Americans that have been unemployed for 27 weeks or longer. This number rose to 3.95 million in the latest period, versus 3.68 million a month earlier. In 2008, the number for the comparable period was 1.57 million.

These numbers are particularly disconcerting because many of these Americans have exhausting their Federal and State unemployment insurance benefits.

With the trend of unemployment still rising and the duration of unemployment still rising, the situation is more dire than it appears on the surface.

Many of the so called experts continue to say that the employment situation is improving based on weekly unemployment claims report. The evidence (although lagging) paints a very different picture of employment in America.

Those investing in stocks should take a good hard look at these numbers. The numbers are telling us that the economy is still at risk.

While the employment situation might not be as bad as it was a few months ago, the situation is still very negative.

It is often true that the stock markets discounts all the bad news before it happens. But the question still remains, has the market discounted the worst of the news, or is the worst news still to come?

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 700 articles with more than 18,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 700 articles with more than 18,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

More from All American Investor

- Bond Vigilantes Take over in the Long End (Graph)

- Ten Year Treasury Yield in Orbit (Graph)

- Ten Year Interest Rates Rising (Chart)

- Option ARM--The Toxic Mortgage

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- 60 Minutes -- Cold Fusion

Follow All American Investor on Twitter

No comments:

Post a Comment