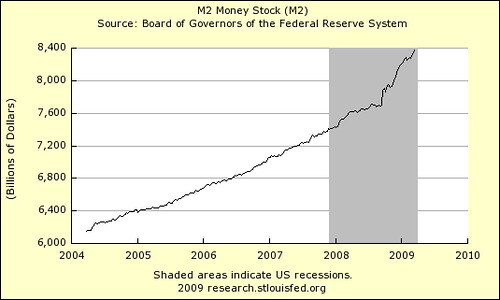

Money Supply as measured by M2 continues to soar. Does anybody really care?

Back in the early 1980s if M2 started rising, the bond vigilantes would have been out in force pushing interest rates higher. Now, not a "peep".

One can only wonder how long it is going to take for this surge in money to take effect. Commodities are at rock bottom as I am writing this.

One thing for sure, if the Fed has acted as it did in the 1930s we would all be eating rocks by now. Potato anyone?

Stay tuned, the fun is going to start very soon.

M2 includes a broader set of financial assets held principally by households. M2 consists of M1 plus:

(1) savings deposits (which include money market deposit accounts, or MMDAs);

(2) small-denomination time deposits (time deposits in amounts of lessthan $100,000);

and (3) balances in retail money market mutual funds(MMMFs).

Seasonally adjusted M2 is computed by summing savings deposits, small-denomination time deposits, and retail MMMFs, each seasonally adjusted separately, and adding this result to seasonally

adjusted M1.

Subscribe to All American Investor via Email

No comments:

Post a Comment