How to make money in the market...look beyond the obvious...spot the trends...and do your homework.

Thursday, August 16, 2012

Morning Journal-Bernanke's mistakes

This Week’s Data

July industrial production was reported at +0.6% versus expectations of +0.5%; capacity utilization came in at 79.4% versus estimates of 79.2%.

http://scottgrannis.blogspot.com/2012/08/industrial-production-remains-healthy.html

Weekly jobless claims rose 5,000 versus forecasts of up 1,000.

http://www.calculatedriskblog.com/2012/08/weekly-initial-unemployment-claims_16.html

July housing starts fell 1.8% versus expectations of a 1.3% drop; however, building permits soared 7.5% versus estimates of a 1.5% increase.

Wednesday, July 18, 2012

Morning Journal-Defective government by design

This Week’s Data

The International Council of Shopping Centers reported weekly sales of major retailers flat versus the prior week but up 2.6% versus the comparable period last year; Redbook Research reported month to date retail chain store sales up 1.7% versus the similar timeframe the prior month but down 1.1% on a year over year basis.

June industrial production rose 0.4% in line with expectations while capacity utilization came in at 78.9 versus estimates of 79.2,

http://mjperry.blogspot.com/2012/07/june-industrial-production-highlights.html

The June consumer price index was reported unchanged versus forecasts of +0.1%; core CPI was up 0.2% as anticipated.

http://www.calculatedriskblog.com/2012/07/bls-cpi-unchanged-in-june.html

Weekly mortgage applications soared 16.9% but purchase applications were down 0.1%.

http://www.calculatedriskblog.com/2012/07/mba-record-low-mortgage-rates-lead-to.html

Wednesday, November 23, 2011

CNBC Portfolio Challenge Bonus Bucks Answers for Thanksgiving, November 24, 2011

ANSWER: 4.5 to 5%

2. According to the 2011 survey on the “Cost of a Thanksgiving Dinner,” what is the increase in the price of a pound of cranberries since last year?

ANSWER: 7 cents

3. UK inflation, currently at 5 percent, has ate into people's purchasing power. But which "category" has been hit hardest by inflation?

Answer: baby boomer (aged 45 - 65)

Thursday, April 30, 2009

Fed Monetizing Debt -- How long before the Inflation Comes?

Over the next week, we will be putting up some of our ideas on how to take advantage of this scenario.

If you have been following the charts on All American Investor -- you noticed that I have been talking about rising rates in the ten and thirty year treasuries for a few weeks. If you are not paying close attention to this as in investor you are making a big mistake.

The bond vigilantes are coming back, and soon with a vengeance. Longer dated treasury interest rates are drifting up. This, in spite, of massive buying of treasuries by the FED -- we showed the balance sheet on Saturday.

Here is a snippet from the latest FOMC release:

As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is facilitating the extension of credit to households and businesses and supporting the functioning of financial markets through a range of liquidity programs. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of financial and economic developments.

Buy $300 billion of treasuries by Autumn?

The best way to think of the current scenario is like boiling water in a tea pot. Sooner or later, the whistle will blow.

Don't like the above? Remember, I am the same guy that predicted this really in stocks when I wrote:

- They call me crazy -- S and P 900-1000

- and, Stocks Don't Fight the Tape.

Subscribe to All American Investor via Email

Saturday, April 18, 2009

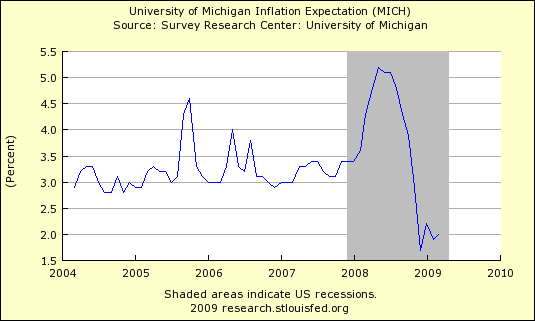

Inflation Expectation, Gasoline and Hershey Bar Up (Graph)

I don't know about you, but when I come out of the grocery store after spending 30 bucks one of two things is happening:

- I am getting a lot stronger

- Or, the bags are a lot lighter.

The chart below is updated through March due to a data embargo. So you will have to use your imagination and add in April's three percent number.

Subscribe to All American Investor via EmailKindle 2: Amazon's New Wireless Reading Device (Latest Generation)

Follow All American Investor on Twitter

Thursday, April 16, 2009

China’s Economy Grows 6.1%, Inflation next?

The important news is that China's industrial production grew 8.3% during March up from 3.8 percent in the first two months. Retail sales rose 14.7%.

The real news here is that commodity prices are going to start rising due to Chinese demand. We already showed the effect, two days ago, on Chinese demand for copper and how it is causing the price of copper to rise sharply.

I continue to encourage investors to get into stocks that will benefit from rising inflation. We will discuss more of these in the days ahead.

I have mentioned the ETF, MOO, several times on this website in the past. This is a good example of a stock that benefits from inflation. We will also be discussing Freeport McMoran (FCX), which we mentioned a few days ago.

We will be discussing good inflation stocks in the days ahead, so remember to stay tune in for those ideas.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments.

Kindle 2: Amazon's New Wireless Reading Device (Latest Generation)

Follow All American Investor on Twitter

Monday, April 06, 2009

Ben Bernanke's Big Inflation Gamble

I am old enough to remember the monster inflation of the late 70s and early 80s. Younger people might find it hard to believe that short term interest rates rose above 20 percent, and a the 30 year Treasury yielded more than 15 percent.

Now Bernanke, the soft-spoken but authoritative academic, has redefined the Federal Reserve on the fly and exercised powers that Greenspan never dared touch. Bernanke's strategy is risky, and only time will determine whether he is being brave in averting a larger crisis, or reckless in unleashing inflation that could increase quickly and uncontrollably. Today, Bernanke's gamble looks like the worst possible alternative, apart from all the others.Simon Johnson and James Kwak are very smart guys. They are excellent at explaining the current economic scenario and putting it into perspective. I suggest you take a good look at their current article.

The Radicalization of Ben Bernanke

Tagline--He is throwing trillions of dollars at the financial crisis. What happens if his gambles don't pay off?Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Tuesday, March 31, 2009

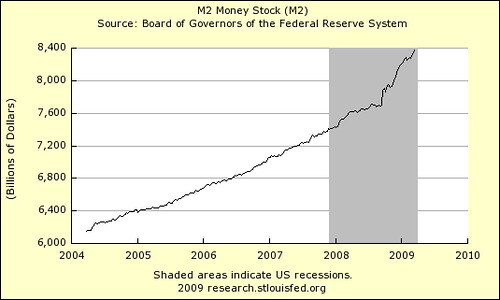

M2, Money Supply Continues to Soar

Money Supply as measured by M2 continues to soar. Does anybody really care?

Back in the early 1980s if M2 started rising, the bond vigilantes would have been out in force pushing interest rates higher. Now, not a "peep".

One can only wonder how long it is going to take for this surge in money to take effect. Commodities are at rock bottom as I am writing this.

One thing for sure, if the Fed has acted as it did in the 1930s we would all be eating rocks by now. Potato anyone?

Stay tuned, the fun is going to start very soon.

M2 includes a broader set of financial assets held principally by households. M2 consists of M1 plus:

(1) savings deposits (which include money market deposit accounts, or MMDAs);

(2) small-denomination time deposits (time deposits in amounts of lessthan $100,000);

and (3) balances in retail money market mutual funds(MMMFs).

Seasonally adjusted M2 is computed by summing savings deposits, small-denomination time deposits, and retail MMMFs, each seasonally adjusted separately, and adding this result to seasonally

adjusted M1.

Subscribe to All American Investor via Email

Sunday, March 22, 2009

Stocks Don't Fight the Tape

I first heard Martin Zweig utter these words--Don't Fight the Tape--at speech he gave in New York city. At the time it really caught my attention. A very simple rule that is easy to understand.

I first heard Martin Zweig utter these words--Don't Fight the Tape--at speech he gave in New York city. At the time it really caught my attention. A very simple rule that is easy to understand.When the Federal Reserve lowered bank reserve requirements at the depths of the recession in 1991-1992, Zweig went bullish after being bearish for some time. He astutely understood that the FED action would have a major impact on banks and then the stock market. Stocks began their march up to 10,000 on the Dow shortly thereafter.

When the Treasury announced this week that they would be purchasing $1 Trillion in assets--Treasuries, mortgages, etc.--those words of Zweig immediately came to mind. The immediate reaction to the news was a monster reversal and rally in the stock market. Jim Cramer was at his manic best right after the news. In the next few days as Congress spent hours and hours discussing the AIG bonuses the market sagged. Nothing like obscuring the real issues to get some free face time--the $165 million is a drop in the bucket.

I think the news that the Treasury is going to buy assets, and keep interest rates low for a long time bears close watching. Often it takes more than a few days for news of this magnitude to get into the market.

Frankly, this is a very bullish development. The big question for me is simple. Is this the news that will help the market consolidate, or is this big big news that sends the market sharply higher. My guess is that we are going to have one monster rally shortly. I could envision the market on the S and P 500 soaring up to 900 or 1000. That would qualify as one heck of a rally.

The best approach in my opinion is to buy stocks that will benefit from inflation. An ETF like MOO would benefit from an increase in inflation (note: I own this ETF).

For those of you that are bearish remember these words--Don't Fight the Tape. For those of you that are bullish take heart--a big bear market rally is coming soon.

Investing Strategy

Martin Zweig's basic stock market strategy is to be fully invested in the market when the indications are positive and to sell stocks when indications become negative. Risk minimization and loss limitation are crucial to his strategy. His book Winning on Wall Street describes how he determines whether to be fully invested or not.

Zweig says, "People somehow think you must buy at the bottom and sell at the top to be successful in the market. That's nonsense. The idea is to buy when the probability is greatest that the market is going to advance". Zweig uses fundamental company data to select stocks to buy while the market is positive.

Subscribe to All American Investor via Email

Thursday, March 19, 2009

The Big Fight Against Deflation

However, there are still many question that need to be answered. Will all consumers be able to refinance? What will consumers do with these cash flow savings? Will consumers spend or save? Will lower mortgage interest rates bring the supply and demand of houses into balance, or will the market continue to suffer from over supply?

The big questions is--what will be the longer term effects of the monetization of debt by the Federal Reserve? Short term this policy should bring an end to the deflations psychology. This is needed. It will bring liquidity into all debt markets; but, at what price? The monetization of debt right now looks like the necessary strategy in the short term. I agree. But, I have severe reservations about the long term.

The goal right now is to get us out of recession.

Is this new strategy a panacea or is it a Pandora's box? We will be looking at this over the weekend.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Friday, March 13, 2009

Over Leveraged American Consumer Needs the Big Inflation

I found this interesting chart over at Calculated Risk.

The chart shows Household Net Worth as a percent of GDP. If you look closely you will notice three things.

- The first big spike up in household net worth occurred during the Internet stock bubble (1996-2000).

- The second big spike up in household net worth occurred when both stocks and housing prices were rising fast (late 2002- late 2007).

- And third, the trend since 1952 is for household net worth to range between 300-350 percent of GDP.

Subscribe to All American Investor via Email

Today, I am reading about Household Debt as a Percent of GDP in the Wall Street. This chart is more worrisome.

When you marry the information on these two charts you can come to a simple conclusion--much of the increase in household net worth was fueled by the taking on of debt by consumers. We have been reading about the over leveraging of companies like Bear Stearns, Lehman Brothers, and AIG; but, not so much about the over leveraging of the American consumer. What is true is that consumers experienced a short term burst in net worth that was fueled by debt. But, now these debts need to be repaid and the consumer will no longer be able to borrow from "peter" to pay "paul". In other words, consumers won't be able to refinance their home and take the proceeds and spend them on houses and cars. They will now have to pay down the debt the old fashioned way.

It should be clear, after looking at these two charts that Household Net Worth has already corrected to a more normalized level--this is a good thing. It should be clear that consumers have a long way to go before they reach the point of more normal leverage on their personnel balance sheets. Many consumers are leveraged beyond their means. Not a good thing.

Retail sales account for two thirds of GDP. It should be clear that consumers are going to need to reduce debt before they can get back to buying houses, cars, and stocks. This means that it is going to be a long time before we see a return to robust gains in the GDP. Not a good thing.

Superimpose on top of these charts: rising unemployment and the sharp rise in government spending. As financial institutions deleverage and consumers face a long period of deleveraging--the government is leveraging up its balance sheet. Another credit bubble waiting to burst? Not a good thing, although necessary.

My guess is that a year or two down the road we will see the stresses from this new bubble--government spending. This will occur as the government finds difficultly financing its debt in the world markets, consumers start to default on credit cards in greater numbers, and the reality that there is no short term fix to a problem that has been building since the early 1980s.

Inflation is a likely to rear its ugly head soon, see (Reserve Balances held by the Federal Reserve Bank are going off the chart). Actually a good thing if you are in debt. You pay back debt with cheaper dollars. This reminded me that I started paying on my student loans in 1978. Loans I took out while I was in college and started paying after graduate school. When I made my last payment in 1988, I was paying with dollars that were worth about one third of what they were worth when I borrowed them (value of a dollar 1988 versus 1970). You might think to yourself right here--big inflation is the way out of this trap. Seems right to me.

My final advice here is straightforward--don't get carried away by the madness of the crowd. You will have plenty of time to buy great stocks at low prices.

Special thanks to Calculated Risk--Fed: Household Net Worth Cliff Dives in Q4, and the Wall Street Journal--Is Debt Ready for a Dive? Both articles are worth reading and considering.

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Monday, March 09, 2009

Buffett Inflation has the "potential" to be worse than the 1970s

He added that inflation “has the potential” to be worse than the double-digit rates of the 1970s. “It depends on the wisdom of our policies, what we do with” new government spending. Buffett said that Republicans need to stand behind the Obama administration, but Obama and Democrats should not use the crisis “to roll Republicans.”Other highlights:

- The economy "can't turn around on a dime" and a turnaround "won't happen fast."

- Five years from now, the economy will be running fine. The strength of the American system will pull it through, just as it has many times in the past.

- Democrats and Republicans should work together and not try to take advantage of the economic situation to achieve partisan goals.

- Inflation has the "potential" to be worse than the 1970s.

- Most banks are in "pretty good shape" and can "earn their way out" of the current problems given the low cost of funds. Banks, however, "need to get back to banking."

- Extremely important that the government make clear depositors won't lose their money if banks fail. Obama needs to make a "clear statement" in support of the banking system.

- Berkshire is restricted from buying more American Express stock, but that doesn't mean it is not a "hell of a buy" at $10 a share.

- Wishes he had written the New York Times "Buy American" piece a few months later, but stands by the basic argument that you'll do better over a ten-year period with stocks that you will with Treasuries. He said in the article he wasn't calling the bottom of the stock market, and he still isn't.

- Buffett says derivatives are not "evil" and to be avoided at all costs, but they are "dangerous" and should be used very carefully. He still expects to make money on the long-term "put option" equity derivative contracts Berkshire has written.

- Housing market could work through, or "sop up," its excess supply in as little as three years if new construction is reduced to a level below natural population growth

- The U.S. economy was not a "house of cards" over the past ten years, but mistakes were made when it came to borrowing money.

- Mark-to-market accounting should be retained, but regulators shouldn't use it so much to require insitutions to increase their reserves.

- "Probably the uptick rule" is a good idea.

- Mistake to "demonize" corporate executives for using private jets. Having a jet has helped Berkshire make deals in the past.

- Praises Ben Bernanke's leadership as Federal Reserve Chairman.

Warren Buffett to CNBC: Economy Has "Fallen Off a Cliff"

Subscribe to All American Investor via Email

Sunday, March 08, 2009

Reserve Balances held by the Federal Reserve Bank are going off the chart

The the U.S. monetary base has increased from approximately $890 billion to $1,740 billion--doubling in a little more than 3 months. This is unprecedented and is represented by the blue line climbing straight up the right side of the chart.

Right now, there is little concern about inflation. However, there should be concern because if markets do not become normalized soon, the Fed will not be able to sell these distressed assets without taking enormous losses. If the Fed is unable to unwind these assets in an orderly fashion then inflation will almost certainly come back with a vengeance.

Gold, oil, and commodity prices should be watched very closely by investors. Even a slight pick up in demand is likely to send commodity price up sharply. Weather factors could also be a factor in the major growing regions of the United States this year--right now it is very dry, not a good condition.

Rises in the monetary base often lead to rises in inflation. The current increase in the monetary base started in the later part of 2007; and then took off with a vengeance in September 2008. There is usually a 12-18 month lag before inflation hits. We are coming into the window right now.

Subscribe to All American Investor via EmailFollow us on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Saturday, February 28, 2009

Money Supply, M2, Year over Year Change

It should be clear from the chart that the Federal Reserve Board has decided that deflation and the current financial crisis are more important that the risk of inflation.

Most forecaster see no inflation problem on the horizon. Many of these same forecasters didn't see a problem in housing. Of course, they failed to add in other components like consumer debt and the unprecedented leveraging of bank and Wall Street balance sheets.

I like to watch stocks like MOO to get a feel about inflation. Gold and MOO are telling a very different story than that being told on television.

By now you may have realized that the more things change the more they stay the same. This unprecedented growth in M2 will lead to a pick up in demand. It is only going to take a small incremental increase in demand for commodities to send the inflation indexes up. We already had a taste of this before the bubble burst.

A picture is worth a thousand words. You are looking at money stock. Think of it as fuel. Commodity prices should be rising soon--lets say in the second half of the year.

Sunday, February 22, 2009

Monday, February 02, 2009

Consumers Spend Less, Boost Savings

Personal saving as a percentage of disposable personal income was 3.6% in December, the highest since 4.8% in May 2008. It was 2.8% in November.

Monday's income and spending data showed disposable personal income -- income after taxes -- fell by 0.2%, following a 0.3% decrease in November.

U.S. construction spending took its third tumble in a row during December as the housing slump wore on, the commercial sector fell, and government outlays dropped.

Total spending decreased by 1.4% at a seasonally adjusted annual rate of $1.054 trillion compared to the prior month, the Commerce Department said Monday. Spending fell 1.2% in November; originally, November spending was seen 0.6% decline. October outlays dropped 0.7%.

Construction spending for 2008 dropped a record 5.1% to $1.079 billion from $1.137 billion during 2007.

Consumers Spend Less, Boost Savings

Subscribe to All American Investor via Email

Sunday, January 11, 2009

PIMCOs Gross likes Muni Bonds and Treasury Inflation Protected Securities

Municipal bonds are among the best buying opportunities now as states line up for billions in federal aid from the incoming Barack Obama administration, said Bill Gross, chief investment officer of the giant bond firm PIMCO.

Other strategies offered by Gross in his January investment newsletter were buying Treasury Inflation Protected Securities (TIPS) and certain investment-grade corporate bonds.

By contrast, in the Treasury market, "low yields offer little reward and increasing risk," given ballooning federal budget deficits, he said.

PIMCO's Gross says muni bonds and TIPS "attractive"

By Ros Krasny

CHICAGO (Reuters) - Municipal bonds are among the best buying opportunities now as states line up for billions in federal aid from the incoming Barack Obama administration, said Bill Gross, chief investment officer of the giant bond firm PIMCO.

Other strategies offered by Gross in his January investment newsletter were buying Treasury Inflation Protected Securities (TIPS) and certain investment-grade corporate bonds.

By contrast, in the Treasury market, "low yields offer little reward and increasing risk," given ballooning federal budget deficits, he said.

Gross noted that requests for aid from municipalities and states total nearly $1 trillion "and to think California or New York City would be allowed to fail is, well -- unthinkable."

"Municipal bonds ... selling at historically high ratios relative to U.S. Treasuries, offer attractive price appreciation potential, or at the very least a defensiveness with high carry that a 2 1/2 percent 10-year Treasury cannot," Gross said.

According to Municipal Market Data, top-rated 30-year munis now yield 161 percent and 10-year munis yield 133 percent of comparable Treasuries.

Triple A rated munis started 2008 yielding a more normal 85 percent of 30-year Treasuries and 79 percent of 10-year government bonds.

Meanwhile, Gross said he doubted the U.S. economy was in for the type of deflation that markets are forecasting, making TIPS a good buy.

Current ultra-low Treasury yields "cannot possibly be maintained unless deflation, as opposed to inflation, becomes the odds-on favorite," he said.

Market-based break-even inflation rates now point to a consumer price index averaging negative 1 percent for the next 10 years, which Gross termed "possible, but not likely."

On the corporate bond side, yields of 6 percent or more for intermediate maturities are still common, Gross said.

"Investors should recognize the value of high-quality, investment-grade corporate bonds in many markets."

Otherwise, PIMCO continues to maintain a strategy of buying assets that are under the federal bailout "umbrella."

"Shake hands with the government ... their checkbook represents the largest and most potent source of buying power in 2009 and beyond," Gross said.

Gross said investors needed to be vigilant about higher inflation over the long term, given the "near certainty of future budget deficits approaching 6 percent to 7 percent of GDP."

(Additional reporting by Karen Pierog; Editing by Kenneth Barry)

Wednesday, January 07, 2009

Fed Officials Worry Inflation Rates Could Ease Too Much

The Fed’s balance sheet has ballooned from less than $900 billion to more than $2 trillion since September Fed’s efforts to purchase debt “have only just begun.” |

Friday, March 30, 2007

Deja Vu Stagflation and the Savings Rate

Real (inflation-adjusted) consumer spending growth slowed to 0.2%, the weakest gain since August. Spending had risen 0.3% in January. Another potential bad sign.

The Fed could soon be facing both accelerating inflation and a slowing economy. And, this is my expectation.

Did you know you can receive the CNBC Portfolio Challenge Bonus Bucks Answers via email by subscribing to this blog?

Subscribe to Robert T DeMarco Weblog by Email