The Report of Condition and Income for All Insured U.S. Commercial Banks continues to deteriorate and is worrisome.

This really calls into question if the new bank bailout plan is going to work. The newest proposal is similar, if not the same, as the plan that was put into effect in September. However, if conditions continue to deteriorate it is likely that banks will need to be seized by the Federal government much like what happened during the Savings and Loan crisis.

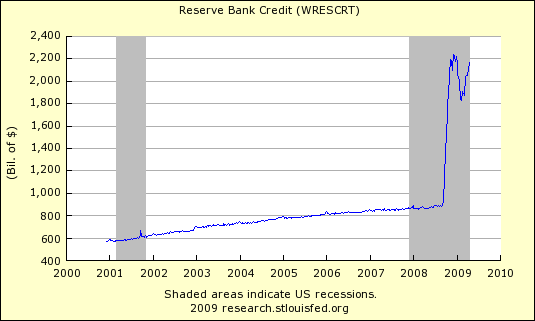

Right now the hope remains that banks can earn their way out of the problem. This explains, in part, why the Federal Reserve is keeping interest rates artificially low and is buying Treasury securities. This strategy worked for the banks in the 1992-1993 period. It is not well known but many banks were "technically" insolvent at the time.

It appears that bank failures, a bank panic, and bank nationalizations are all still real possibilities.

We will continue to watch this situation at All American Investor.

Sidenote: Federal regulators Friday seized control of the two largest wholesale credit unions — U.S. Central Federal Credit Union and Western Corporate Federal Credit Union — which together had $57 billion in assets. This went virtually unnoticed.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Wireless Reading Device

Wireless Reading Device