As the market is in an extremely precarious place right now we felt it prudent to relay to you the details of the current setup for the old Thursday/Monday Syndrome.

With a penchant for history, a rapier wit and a refreshing sense of humor here’s how the always salient Art Cashin, Director of Floor Operations for UBS Financial Services and a regular markets commentator on CNBC, described this ominous possibility in his daily comments today:

How to make money in the market...look beyond the obvious...spot the trends...and do your homework.

Showing posts with label stock. Show all posts

Showing posts with label stock. Show all posts

Saturday, September 24, 2011

Wednesday, September 01, 2010

Mastercard (MA) Notes and Chart

By Steve Cook

All American Investor

Mastercard (MA)is a global leader in electronic payments serving as a processor, franchisor and advisor to approximately 25,000 financial institutions for their credit, debit and other payment programs. In addition, it manages a family of payment card brands.

All American Investor

Mastercard (MA)is a global leader in electronic payments serving as a processor, franchisor and advisor to approximately 25,000 financial institutions for their credit, debit and other payment programs. In addition, it manages a family of payment card brands.

Labels:

chart,

investing,

mastercard,

notes,

stock

Tuesday, July 21, 2009

Real Estate Loans at All Commercial Banks (Three Looks, Graph)

When I looked at this chart, I thought no way. This trend cannot be sustained in this environment.

So I decided to take a look from a different perspective. Percent change from a year ago.

Sure enough, this gives a more realistic view of what is going on in the real estate loan market. Notice that the peaks are getting lower. The peak in 2007 should come as no surprise.

The big question? Is lending going to turn negative? And what effect would that have on the economy and stocks? It would scare people to death for sure.

Next I decided to look at the 20 year view?

Hmm. This is really interesting. Look at the long downtrend that started after the stock market crash of 1987. Straight into 1993. I wonder why we didn't need TARP in those days?

No wonder houses were so cheap in the second half of the 90s. In some parts of the country (Florida, Texas) they were giving houses away. And obviously, they weren't building many new houses.

I think its time to buy a house. Looks like a real opportunity to me. Especially if you know how to go into a bank and negotiate for a house that is currently stuck in their roach motel of homes.

I also think you should be careful. It appears to me that the trend down in loans is going to continue for a while. So stay away from the temptation to buy anything associated with housing.

Look for the real opportunities.

Kindle: Amazon's 6"  Wireless Reading Device

Wireless Reading Device

So I decided to take a look from a different perspective. Percent change from a year ago.

Sure enough, this gives a more realistic view of what is going on in the real estate loan market. Notice that the peaks are getting lower. The peak in 2007 should come as no surprise.

The big question? Is lending going to turn negative? And what effect would that have on the economy and stocks? It would scare people to death for sure.

Next I decided to look at the 20 year view?

Hmm. This is really interesting. Look at the long downtrend that started after the stock market crash of 1987. Straight into 1993. I wonder why we didn't need TARP in those days?

No wonder houses were so cheap in the second half of the 90s. In some parts of the country (Florida, Texas) they were giving houses away. And obviously, they weren't building many new houses.

I think its time to buy a house. Looks like a real opportunity to me. Especially if you know how to go into a bank and negotiate for a house that is currently stuck in their roach motel of homes.

I also think you should be careful. It appears to me that the trend down in loans is going to continue for a while. So stay away from the temptation to buy anything associated with housing.

Look for the real opportunities.

Wireless Reading Device

Wireless Reading Device

Labels:

banks,

commercial,

graph,

housing,

loans,

real estate,

stock

Wednesday, May 06, 2009

They called me crazy, S and P 900-1000 (Part Two)

When I wrote Stocks Don't Fight the Tape the S and P 500 was around 768. I predicted a rally into the 900-1000 area.

I followed that up with They called me crazy, S and P 900-1000

What next?

This has been a tremendous rally that I expected. However, in terms of price and duration it fits the requirements for a correction in a market that is still trending down.

In addition, the longer dated treasury interest rates are turning up. This is a negative. The dollar looks very vulnerable right now. Another negative. The combination of rising rates in the long end and a dropping dollar does not bode well for stocks.

Follow All American Investor on Twitter

I followed that up with They called me crazy, S and P 900-1000

What next?

- The stock market is currently overbought.

- The technical correction in the current bear market is two months old.

- A major retracement to the downside is likely, and is imminent.

- We could see additional upside to the 940 area versus the S and P 500.

- A test of the 840 area is likely.

- Once the correction gets underway we should get a better understanding of the structure of the market. Begining of long term bull, or bear market still in tact?

- The important 200 day average is still about 100 points above the market and the down ward slope of that average is becoming more severe. This is not a good sign.

This has been a tremendous rally that I expected. However, in terms of price and duration it fits the requirements for a correction in a market that is still trending down.

In addition, the longer dated treasury interest rates are turning up. This is a negative. The dollar looks very vulnerable right now. Another negative. The combination of rising rates in the long end and a dropping dollar does not bode well for stocks.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Monday, April 13, 2009

Roubini: Stress Test Results are Meaningless

The word on the street is that all 19 banks subject to stress testing will pass. Nouriel Roubini has a long article on the assumptions underneath the testing and why they are bogus or no longer meaningful.

The purpose of the stress testing, as I see it, is to create confidence in banks. As a result, the perception in the market place is going to be critical for the direction of the stock market. Will the stress tests create confidence or more uncertainty?

Uncertainty is not good for stocks, and would likely send us back for a retest of the lows.

Roubini has a lot of detail in this report and it is worth reading, digesting, and considering. If he is right, sooner or later it is going to be very ugly in the stock market.

The stock market has good technical resilance right now and I have been writing about this often. However, the bull run from the bottom is getting a little long in the touch and the risk/reward ratio is starting to turn negative.

Stress Testing the Stress Test Scenarios

Subscribe to All American Investor via Email

Follow All American Investor on Twitter

Labels:

"Nouriel Roubini",

banks,

market,

Roubini,

stock,

stress test

Tuesday, April 07, 2009

Hot HMO Stock (Chart)

After getting crushed in February, Humana (HUM) is now up 34 percent in the last 20 days. It is also up more than 5 percent today.

Notes:

Notes:

- Humana is now bumping up against the red line (two standard deviations above the line), so it is likely to meet stiff resistance near term.

- The stock is trying to break above strong congestion at $25.

- The bottom of the gap left over from the big break down is $39.36.

- The stocks is being touted in today's news and it would be a good idea for interested investors to take a look.

- A good close above $25 is likely to set the stock on a path to fill the gap.

Subscribe to All American Investor via Email

Sunday, March 29, 2009

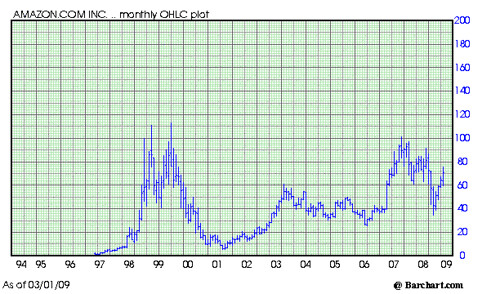

Is the Barrons Cover the Kiss of Death for Jeff Bezos and Amazon (AMZN)?

Wow. Last night, just after midnight I wrote about Amazon (AMZN)--Amazon . Toast up 5000 percent since IPO (Chart).

Wow. Last night, just after midnight I wrote about Amazon (AMZN)--Amazon . Toast up 5000 percent since IPO (Chart).Next thing I know, an article from Barron's pops into my reader--The World's Best Retailer. Ironic? Well, yeah.

Here is a note of caution. Jeff Bezos is on the cover of Barron's this week. Why is this important?

If you read my article, Amazon . Toast, all the way to the end you would have noticed that Jeff Bezos was named Time's person of the year in 1999. What happened next? The stock dropped from a split adjusted $113 a share, all the way down to $5.67. Yikes.

Is the Barron's cover the kiss of death for Jeff Bezos and Amazon?

Subscribe to All American Investor via Email

Jeff Bezos' Amazon.com is winning customers with competitive prices, wide selection, reliability -- and Kindle. It's winning shareholders, too.

The World's Best Retailer --Barron's

THIS MAY BE AN OPPORTUNE time to add shares of Amazon.com to your shopping cart and proceed to checkout.Now, Amazon is taking that a step further by providing Web services, better known these days as "cloud computing." What is cloud computing? It is the outsourcing of information-technology and data-center operations to third parties, mostly by small- and medium-sized companies that choose not to spend their resources to deal with these tasks themselves. (The name cloud derives from the remote ether-like computer space where the outsourced operations take place.) Amazon, which has spent more than $2 billion on its systems in the last decade, has divided these services into several parts, including: Amazon Simple DB (databases), Amazon Elastic Compute Cloud (computing capacity) and Amazon Simple Storage (data storage).

Price believes these services could eventually generate hundreds of millions of dollars annually -- and investors are getting them for almost nothing.

The second kicker is Kindle, a digital-reading device. Its original version was generally well received, but its recently released 2.0 edition has become a hit with consumers. Wall Street analysts estimate the company has sold 350,000 of the devices, which got a plug from Oprah Winfrey last fall.

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Go See Kindle

Amazon . Toast up 5000 percent since IPO (Chart)

Amazon (AMZN), Ten Year Chart, Monthly.

Highlights:

A month after Jeff Bezos' was named Time's person of the year, the company fired 150 workers as part of an internal reorganization. Just five days later, Amazon reported a loss of $323 million for the holiday fourth quarter and promised that future losses would be lower. (The company, however, would later exceed that amount by more than $200 million).

A month after Jeff Bezos' was named Time's person of the year, the company fired 150 workers as part of an internal reorganization. Just five days later, Amazon reported a loss of $323 million for the holiday fourth quarter and promised that future losses would be lower. (The company, however, would later exceed that amount by more than $200 million).

Follow All American Investor on Twitter

In May, 1997 Amazon (AMZN) was labeled Amazon.toast and Amazon.bomb by Forrester Research and Barron's. Since then it has risen more than 5,000 percent.

Highlights:

- Amazon was founded in 1994, and went public in 1997.

- In 1997, Amazon was labeled Amazon.toast and Amazon.bomb by Forrester Research and Barron's.

- By 1999, cumulative losses at Amazon exceeded $550 million.

- In December, 1999, Jeff Bezos was chosen as Time magazine's person of the year (see Cover).

- In December 1999, Amazon reached its highest raw price in history at $113 a share.

- In the summer of 2000, an analyst at Lehman Brothers warned investors that the company might run out of cash and advised them to avoid its stock.

- In September 2001, Amazon dropped to its lowest raw price in history--$5.67 a share.

- In October, 2007 Amazon traded over $100 a share for the third time, and the first time since 1999.

- The split adjusted price of Amazon dating back to 1997 is $1.31 a share.

- On March 23, 2009 Amazon closed at $75.61 a share, its highest price since falling to $34.68 a share in November, 2008.

- Amazon is currently up more than 50 times its adjusted initial public offering price, or 5,700 percent.

A month after Jeff Bezos' was named Time's person of the year, the company fired 150 workers as part of an internal reorganization. Just five days later, Amazon reported a loss of $323 million for the holiday fourth quarter and promised that future losses would be lower. (The company, however, would later exceed that amount by more than $200 million).

A month after Jeff Bezos' was named Time's person of the year, the company fired 150 workers as part of an internal reorganization. Just five days later, Amazon reported a loss of $323 million for the holiday fourth quarter and promised that future losses would be lower. (The company, however, would later exceed that amount by more than $200 million).Follow All American Investor on Twitter

Subscribe to All American Investor via Email

Saturday, March 28, 2009

GoldCorp (GG) Twelve Times Your Money in Ten Years (Chart)

Gold Corp (GG), Ten Year Chart, Monthly (not dividend adjusted).

You don't hear much about Gold Corp (GG). The gold stock has risen from the $2.50 area in 1999 to a high of $52.65 during July, 2008 (prices are adjusted for stock splits).

The stock closed Friday at $33.76. GoldCorp dropped to a low in the $14.00 area in October, 2008 and is now moving up again.

If you had invested $10,000 in GoldCorp in 1999, it would now be worth more than $125,000. This does not include adjustments for dividends. 12.5 times your money in ten years, not bad.

Follow All American Investor on Twitter

More from All American Investor

You don't hear much about Gold Corp (GG). The gold stock has risen from the $2.50 area in 1999 to a high of $52.65 during July, 2008 (prices are adjusted for stock splits).

The stock closed Friday at $33.76. GoldCorp dropped to a low in the $14.00 area in October, 2008 and is now moving up again.

If you had invested $10,000 in GoldCorp in 1999, it would now be worth more than $125,000. This does not include adjustments for dividends. 12.5 times your money in ten years, not bad.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Wednesday, March 25, 2009

They called me crazy, S and P 900-1000

On Sunday, I wrote an article on this blog entitled, Stocks Don't Fight the Tape.

In the article I wrote the following,

On the open yesterday, I pointed out that the S and P 500 chart indicated the market was overbought. The S and P was hitting its red line (two standard deviations above the mean). The statistical odds always favor a pullback when that happens. The other point I was making, was that, the market now has some good technical resilience. This is a necessary component before a market can get into a healthy uptrend.

Just so you won't think I am some kind of all the time bulldog, you can go read an article I wrote on this blog when I was nutsy bearish back in September--Financial Meltdown--Where there is Smoke, there is Fire. I concluded that article by saying, "cash was king". At the time, the S and P 500 was well above 1200.

This investment blog is relatively new. I am seeking more subscribers (free). If you think this is worthwhile please subscribe. And then, tell your friends. Thanks.

The purpose here is to keep you thinking and help you make good decisions. On occasion you will find some gems like, Don't Fight the Tape.

In the article I wrote the following,

My guess is that we are going to have one monster rally shortly. I could envision the market on the S and P 500 soaring up to 900 or 1000. That would qualify as one heck of a rally.When I wrote that article the S and P 500 was at 768.54.

On the open yesterday, I pointed out that the S and P 500 chart indicated the market was overbought. The S and P was hitting its red line (two standard deviations above the mean). The statistical odds always favor a pullback when that happens. The other point I was making, was that, the market now has some good technical resilience. This is a necessary component before a market can get into a healthy uptrend.

Just so you won't think I am some kind of all the time bulldog, you can go read an article I wrote on this blog when I was nutsy bearish back in September--Financial Meltdown--Where there is Smoke, there is Fire. I concluded that article by saying, "cash was king". At the time, the S and P 500 was well above 1200.

This investment blog is relatively new. I am seeking more subscribers (free). If you think this is worthwhile please subscribe. And then, tell your friends. Thanks.

The purpose here is to keep you thinking and help you make good decisions. On occasion you will find some gems like, Don't Fight the Tape.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Sunday, March 22, 2009

Stocks Don't Fight the Tape

I first heard Martin Zweig utter these words--Don't Fight the Tape--at speech he gave in New York city. At the time it really caught my attention. A very simple rule that is easy to understand.

I first heard Martin Zweig utter these words--Don't Fight the Tape--at speech he gave in New York city. At the time it really caught my attention. A very simple rule that is easy to understand.When the Federal Reserve lowered bank reserve requirements at the depths of the recession in 1991-1992, Zweig went bullish after being bearish for some time. He astutely understood that the FED action would have a major impact on banks and then the stock market. Stocks began their march up to 10,000 on the Dow shortly thereafter.

When the Treasury announced this week that they would be purchasing $1 Trillion in assets--Treasuries, mortgages, etc.--those words of Zweig immediately came to mind. The immediate reaction to the news was a monster reversal and rally in the stock market. Jim Cramer was at his manic best right after the news. In the next few days as Congress spent hours and hours discussing the AIG bonuses the market sagged. Nothing like obscuring the real issues to get some free face time--the $165 million is a drop in the bucket.

I think the news that the Treasury is going to buy assets, and keep interest rates low for a long time bears close watching. Often it takes more than a few days for news of this magnitude to get into the market.

Frankly, this is a very bullish development. The big question for me is simple. Is this the news that will help the market consolidate, or is this big big news that sends the market sharply higher. My guess is that we are going to have one monster rally shortly. I could envision the market on the S and P 500 soaring up to 900 or 1000. That would qualify as one heck of a rally.

The best approach in my opinion is to buy stocks that will benefit from inflation. An ETF like MOO would benefit from an increase in inflation (note: I own this ETF).

For those of you that are bearish remember these words--Don't Fight the Tape. For those of you that are bullish take heart--a big bear market rally is coming soon.

Investing Strategy

Martin Zweig's basic stock market strategy is to be fully invested in the market when the indications are positive and to sell stocks when indications become negative. Risk minimization and loss limitation are crucial to his strategy. His book Winning on Wall Street describes how he determines whether to be fully invested or not.

Zweig says, "People somehow think you must buy at the bottom and sell at the top to be successful in the market. That's nonsense. The idea is to buy when the probability is greatest that the market is going to advance". Zweig uses fundamental company data to select stocks to buy while the market is positive.

Subscribe to All American Investor via Email

Saturday, March 21, 2009

Money Supply continues to Soar (Chart)

M2, Money Stock continues to soar and accelerate. Chart current through March 20.

Subscribe to All American Investor via Email

Wednesday, March 18, 2009

Are Dead Cat Bounces Common in the Stock Market? Yes

The following lists the bear market rallies, and the duration, from 1929-1933.

The following list the bear market rallies, and the duration, from 2007- to the present.

Good information and perspective that I picked up over on FT Alphaville.

The following list the bear market rallies, and the duration, from 2007- to the present.

Good information and perspective that I picked up over on FT Alphaville.

Subscribe to All American Investor via Email

Sunday, March 15, 2009

Roubini on the Dead Cat Bounce in the Market

It is déjà vu all over again. We have already seen this Groundhog Day movie at least six times over and over again in the last year or so: the market starts to rally – this time around about 8% in a week - and the chorus of optimists starts to say that this is the bottom of the economic and financial crisis and that we are at the beginning of a sustained stock market rally that signals the true end of this bear market.Read Nouriel Roubini's full comment--

Even before the latest bear market rally started last week I wrote the following on March 2nd:

Of course you cannot rule out another bear market sucker’s rally in 2009, most likely in Q2 or Q3: the drivers of this rally will be the improvement in second derivatives of economic growth and activity in US and China that the policy stimulus will provide on a temporary basis: but after the effects of tax cut will fizzle out in late summer and after the shovel-ready infrastructure projects are done the policy stimulus will slack by Q4 as most infrastructure projects take year to be started let alone finished; similarly in China the fiscal stimulus will provide a fake boost to non-tradeable productive activities while the traded sector and manufacturing continues to contract. But given the severity of macro, household, financial firms and corporate imbalances in the US and around the world this Q2 or Q3 sucker’s market rally will fizzle out later in the year like the previous 5 ones in the last 12 months.

Reflections on the latest dead cat bounce or bear market sucker’s rallySubscribe to All American Investor via Email

Labels:

"Nouriel Roubini",

bear market,

blog,

bounce,

cat,

dead,

market,

rally,

Roubini,

stock

Dead Cat Bounce for Stocks?

A "dead cat bounce" is a term used by traders to describe short lived rallies in the stock market during bear markets. It is also used in the futures market.

During a "rip roaring" bear market you often see hard, short lived, rallies to the upside. When these rallies occur there is often an accompanying sense of relief on the part of investors. Some investors, however, become anxious believing they are missing something and they jump into the market--they buy. Shorts often help fuel dead cat bounces--they turn buyer to cover their shorts.

There is a second type of short I call the "johnny come lately". This very emotional trader reaches a point where they can't stand it anymore and they short the market into a near term low--right before a dead cat bounce. They never consider that the market has been going down for some time and is subject to a correction within the down trend--the dead cat bounce. "Johnny come lately's" sit back and watch the market drop like a lead brick until they reach the point where they can't stand it anymore--they short the market. Looking for a quick killing, JCLs help fuel the, short lived, up side rally by covering their shorts (they turn buyer to cover). Sometimes they are the "cat".

Dead cat bounces are often spectacular in their nature. Hard, fast, often greater than 10 percent, and short lived. Ten percent or more by any standard is a big rally. You can get hurt bad if you short the market at the bottom right before a dead cat bounce.

I am not sure how the term "dead cat bounce" came into being. I do know that if you lived in New York City long enough you will hear a story about a cat that fell out the window (say about 30 stories down). They do bounce, and they do leave a mark. The cat ends up fully intact but dead. The mark they leave looks like a big wet spot. Enough said.

Words of wisdom in a bear market. Never try and catch a falling knife.

During a "rip roaring" bear market you often see hard, short lived, rallies to the upside. When these rallies occur there is often an accompanying sense of relief on the part of investors. Some investors, however, become anxious believing they are missing something and they jump into the market--they buy. Shorts often help fuel dead cat bounces--they turn buyer to cover their shorts.

There is a second type of short I call the "johnny come lately". This very emotional trader reaches a point where they can't stand it anymore and they short the market into a near term low--right before a dead cat bounce. They never consider that the market has been going down for some time and is subject to a correction within the down trend--the dead cat bounce. "Johnny come lately's" sit back and watch the market drop like a lead brick until they reach the point where they can't stand it anymore--they short the market. Looking for a quick killing, JCLs help fuel the, short lived, up side rally by covering their shorts (they turn buyer to cover). Sometimes they are the "cat".

Dead cat bounces are often spectacular in their nature. Hard, fast, often greater than 10 percent, and short lived. Ten percent or more by any standard is a big rally. You can get hurt bad if you short the market at the bottom right before a dead cat bounce.

I am not sure how the term "dead cat bounce" came into being. I do know that if you lived in New York City long enough you will hear a story about a cat that fell out the window (say about 30 stories down). They do bounce, and they do leave a mark. The cat ends up fully intact but dead. The mark they leave looks like a big wet spot. Enough said.

Words of wisdom in a bear market. Never try and catch a falling knife.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Monday, March 09, 2009

Chart S an P 500 Support 652 and dropping--March 9

We are using the S and P 500 March futures contract this morning.

Support continues to decline and is now around the 652 area. Price drops more than one percent below this level should find good support today.

There is good news as the momentum behind the downside thrust is slowing. However, the market is still subject to a potential downside market capitulation at any time. A hard downside thrust, or continued slow deterioration is likely to trigger mutual fund selling.

Many forecasters are calling for a low around the S and P 500, 600 level. This almost seems like a self fulfilling prophesy coming to fruition. Maybe, maybe not.

Source: Barchart.com

Follow us on Twitter

More from All American Investor

Support continues to decline and is now around the 652 area. Price drops more than one percent below this level should find good support today.

There is good news as the momentum behind the downside thrust is slowing. However, the market is still subject to a potential downside market capitulation at any time. A hard downside thrust, or continued slow deterioration is likely to trigger mutual fund selling.

Many forecasters are calling for a low around the S and P 500, 600 level. This almost seems like a self fulfilling prophesy coming to fruition. Maybe, maybe not.

Source: Barchart.com

Subscribe to All American Investor via Email

Follow us on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Friday, March 06, 2009

Market Capitulation are Mutual Funds Next?

Rumors are starting that a couple of mutual funds are in trouble. I can't confirm or deny at the moment.

Earlier this week I wrote about the increase in investors calls to both Vanguard and T. Rowe Price. See Investors pull $33 Billion out of Market.

When investors get scared, and they can't take it anymore, they often dump all their stocks. A form of the madness of the crowd--they sometimes do this in unison. Imagine 100,000s of investors all pushing the panice button at the same time. There are somewhere in the neighborhood of 88 million investors in the United States.

Could we be on the verge of a market capitulation?

See: Market Capitulation Means Big Opportunity to Make Money and S an P Support 659 and dropping, Market Capitulation?

Earlier this week I wrote about the increase in investors calls to both Vanguard and T. Rowe Price. See Investors pull $33 Billion out of Market.

When investors get scared, and they can't take it anymore, they often dump all their stocks. A form of the madness of the crowd--they sometimes do this in unison. Imagine 100,000s of investors all pushing the panice button at the same time. There are somewhere in the neighborhood of 88 million investors in the United States.

Could we be on the verge of a market capitulation?

See: Market Capitulation Means Big Opportunity to Make Money and S an P Support 659 and dropping, Market Capitulation?

Subscribe to All American Investor via Email

Labels:

"market capitulation",

bear market,

blog,

chart,

economy,

mutual fund,

stock,

trading

Thursday, March 05, 2009

Is it time to buy Yamana Gold

Yamana gold is well known by institutional investors and Jim Cramer. The company has a market cap around $6 Billion.

This chart looks good to me. The chart shows this stock continues to make higher highs, and higher lows. Always a good thing.

The only thing that would bother me right now is the seasonal pattern for gold. Gold tends to make its seasonal high in the February 15-March 15 period. From that point it tends to trend down into the summer. Gold tends to bottom in the August 15-October 15 period.

Gold almost almost always rises from October 15- February 15 no matter what. This is due to strong seasonal demand that comes in the form of physical buying for jewelry, and strong buying out of China and India. I intend to write about this soon.

This is not a recommendation to buy or sell. File this under food for thought. Now go do some homework.

This chart looks good to me. The chart shows this stock continues to make higher highs, and higher lows. Always a good thing.

The only thing that would bother me right now is the seasonal pattern for gold. Gold tends to make its seasonal high in the February 15-March 15 period. From that point it tends to trend down into the summer. Gold tends to bottom in the August 15-October 15 period.

Gold almost almost always rises from October 15- February 15 no matter what. This is due to strong seasonal demand that comes in the form of physical buying for jewelry, and strong buying out of China and India. I intend to write about this soon.

This is not a recommendation to buy or sell. File this under food for thought. Now go do some homework.

Monday, March 02, 2009

Jim Cramer is a Crybaby

On Mad Money yesterday Jim Cramer cried like a baby--like the little boy that cried wolf.

This is the same Jim Cramer that was nutsy bullish when stocks were above 1300 and getting ready to crash.

The same Jim that failed to understand the interconnectedness of financial services companies, banks, and insurance companies. It never dawned on him, despite his many years in the markets, that all these companies were doing business with each other and they were all in the same boat.

Jim knows, as well as anyone, that much of what is happening right now in the stock market was inevitable--it was already baked in. If the government had not intervened on behalf of AIG the stock market would be lower than it is today. There was no alternative. Jim knows this.

Last week, Jim threw out one of his great brainstorms--give everyone in the United States a 4 percent mortgage. The government would pay for this. I guess that is Jim's idea of a plan.

Jim is crying about all the investors that are getting hurt in their 401-Ks and IRA accounts. They would have gotten hurt even if we were in the old pension age of defined benefits programs. The guys running State Funds, endowments, and the like are getting killed just like everyone else. Even the world's greatest investor, Warren Buffett, is getting mauled in the market. The big difference, however, is that Warren isn't crying like a baby.

On September 16, 2008 I wrote, Financial Meltdown--Where there is Smoke, there is Fire (at the time the S and P 500 was above 1200). In that article, I talked about the interconnectedness of financial institutions and predicted that the financial system was going to meltdown. I ended that article with these words--cash is king. This was not a popular view at the time. Shortly thereafter, the market started on its way to the current S and P price near 700. .

Jim Cramer should have seen what was coming. He didn't.

Unlike Jim, I understand that it is always darkest before the dawn. Retail investors will likely capitulate soon, and the bottom will be in--in stocks. Of course, all Jim is doing on Mad Money is helping investors jump the ship and fostering the old school idea of vilification.

Jim is too full of himself to see the Renaissance coming. We are ready to embark on a technological revolution in this country. The biggest infrastructure play in history. This is going to cost money Jim, and money doesn't grow on trees. Everyone is participating Jim, not just the rich. In all my years on Wall Street I never heard a single person complain about taxes. We made enough money to pay the tax, and had enough left over to eat all the cheese steaks we wanted. I admit, I wasn't hanging out with Jim and his crowd.

In the not so distant future we will import our last drop of Middle East oil. We will develop alternative energy much in the same fashion as when we went to the moon--sooner than anyone thought possible. Soon, our students will develop pointy heads and we will have a new generation of scientists and engineers that will ring in the innovations of the future. Utilization of existing and new technologies will cut the cost of health care by amounts that cannot yet be imagined.

This is a good thing and astute investors will make fortunes identifying the Intel's and CSCOs' of the alternative energy and infrastructure future.

My mother is 92 years old. She remembers riding on her father's milk truck--it was powered by a horse. Her grandchildren will be riding around the country on trains that go 200 miles per hour during their lifetime.

My 80 year old neighbor just drove 34 miles round trip to take her prescription over to the only pharmacy in Palm Beach county that makes compounds. The next day she drove another 34 miles to pick up the prescription. If she had our doctor she would have driven 34 miles, instead of 68 miles. Our doctor already has the paperless environment. Our doctor sends new prescriptions--via computer--directly to the pharmacy. This is our future. Save gas and same time. Increased productivity. Jim Cramer is old enough to remember when they delivered stocks certificates around Wall Street at the close of business. Same deal.

It is always darkest before the dawn. In the 1980s we had annualized inflation rates above 15 percent. The Prime rate was above 20 percent. Oil surged from the 70s price of $2 a barrel to $40 a barrel. The ten year Treasury yielded more than 15 percent. Ronald Reagan ran up the biggest deficits in the history of the planet earth. Banks and Savings and loans failed. Real estate prices dropped like a lead stone in Texas and the Southwest (and later in New York, New Jersey, and Connecticut). The stock market crashed 40 percent in a couple of months. Almost 30 percent in a day. We survived.

The country is coming off a credit and leverage binge. The hangover is devastating, This is what happens when you suffer an addiction. We are in rehab right now.

Jim, we live in the United States of America. This is not the first time we find ourselves in a dire situation. When the going gets tough new leadership emerges in our country. Men and women of vision. The American people love the challenge of a new vision and we the people are ready to carry out the mission. We know it won't be easy. This is our moment Jim, stop crying.

Jim does have good ideas and that is why I watch his show. In other words, you never know where the next great investment idea is going to come from, so you have to keep your eyes and ears open.

More from All American Investor

This is the same Jim Cramer that was nutsy bullish when stocks were above 1300 and getting ready to crash.

The same Jim that failed to understand the interconnectedness of financial services companies, banks, and insurance companies. It never dawned on him, despite his many years in the markets, that all these companies were doing business with each other and they were all in the same boat.

Subscribe to All American Investor via EmailJim wants to blame President Obama for the nose dive in the stock market. In fact, Jim wants to blame just about everyone but himself.

Jim knows, as well as anyone, that much of what is happening right now in the stock market was inevitable--it was already baked in. If the government had not intervened on behalf of AIG the stock market would be lower than it is today. There was no alternative. Jim knows this.

Last week, Jim threw out one of his great brainstorms--give everyone in the United States a 4 percent mortgage. The government would pay for this. I guess that is Jim's idea of a plan.

Jim is crying about all the investors that are getting hurt in their 401-Ks and IRA accounts. They would have gotten hurt even if we were in the old pension age of defined benefits programs. The guys running State Funds, endowments, and the like are getting killed just like everyone else. Even the world's greatest investor, Warren Buffett, is getting mauled in the market. The big difference, however, is that Warren isn't crying like a baby.

On September 16, 2008 I wrote, Financial Meltdown--Where there is Smoke, there is Fire (at the time the S and P 500 was above 1200). In that article, I talked about the interconnectedness of financial institutions and predicted that the financial system was going to meltdown. I ended that article with these words--cash is king. This was not a popular view at the time. Shortly thereafter, the market started on its way to the current S and P price near 700. .

Jim Cramer should have seen what was coming. He didn't.

Unlike Jim, I understand that it is always darkest before the dawn. Retail investors will likely capitulate soon, and the bottom will be in--in stocks. Of course, all Jim is doing on Mad Money is helping investors jump the ship and fostering the old school idea of vilification.

Jim is too full of himself to see the Renaissance coming. We are ready to embark on a technological revolution in this country. The biggest infrastructure play in history. This is going to cost money Jim, and money doesn't grow on trees. Everyone is participating Jim, not just the rich. In all my years on Wall Street I never heard a single person complain about taxes. We made enough money to pay the tax, and had enough left over to eat all the cheese steaks we wanted. I admit, I wasn't hanging out with Jim and his crowd.

In the not so distant future we will import our last drop of Middle East oil. We will develop alternative energy much in the same fashion as when we went to the moon--sooner than anyone thought possible. Soon, our students will develop pointy heads and we will have a new generation of scientists and engineers that will ring in the innovations of the future. Utilization of existing and new technologies will cut the cost of health care by amounts that cannot yet be imagined.

This is a good thing and astute investors will make fortunes identifying the Intel's and CSCOs' of the alternative energy and infrastructure future.

My mother is 92 years old. She remembers riding on her father's milk truck--it was powered by a horse. Her grandchildren will be riding around the country on trains that go 200 miles per hour during their lifetime.

My 80 year old neighbor just drove 34 miles round trip to take her prescription over to the only pharmacy in Palm Beach county that makes compounds. The next day she drove another 34 miles to pick up the prescription. If she had our doctor she would have driven 34 miles, instead of 68 miles. Our doctor already has the paperless environment. Our doctor sends new prescriptions--via computer--directly to the pharmacy. This is our future. Save gas and same time. Increased productivity. Jim Cramer is old enough to remember when they delivered stocks certificates around Wall Street at the close of business. Same deal.

It is always darkest before the dawn. In the 1980s we had annualized inflation rates above 15 percent. The Prime rate was above 20 percent. Oil surged from the 70s price of $2 a barrel to $40 a barrel. The ten year Treasury yielded more than 15 percent. Ronald Reagan ran up the biggest deficits in the history of the planet earth. Banks and Savings and loans failed. Real estate prices dropped like a lead stone in Texas and the Southwest (and later in New York, New Jersey, and Connecticut). The stock market crashed 40 percent in a couple of months. Almost 30 percent in a day. We survived.

The country is coming off a credit and leverage binge. The hangover is devastating, This is what happens when you suffer an addiction. We are in rehab right now.

Jim, we live in the United States of America. This is not the first time we find ourselves in a dire situation. When the going gets tough new leadership emerges in our country. Men and women of vision. The American people love the challenge of a new vision and we the people are ready to carry out the mission. We know it won't be easy. This is our moment Jim, stop crying.

Jim does have good ideas and that is why I watch his show. In other words, you never know where the next great investment idea is going to come from, so you have to keep your eyes and ears open.

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Labels:

"jim Cramer",

"mad money",

blog,

market,

obama,

stock

Saturday, February 28, 2009

Money Supply, M2, Year over Year Change

Money supply is growing very fast. It has not yet had an impact on inflation. Delays in this effect usually take 12-18 months. The last trough in M2 occurred in December, 2007. Since then, M2 has been growing at an unprecedented pace.

It should be clear from the chart that the Federal Reserve Board has decided that deflation and the current financial crisis are more important that the risk of inflation.

Most forecaster see no inflation problem on the horizon. Many of these same forecasters didn't see a problem in housing. Of course, they failed to add in other components like consumer debt and the unprecedented leveraging of bank and Wall Street balance sheets.

I like to watch stocks like MOO to get a feel about inflation. Gold and MOO are telling a very different story than that being told on television.

By now you may have realized that the more things change the more they stay the same. This unprecedented growth in M2 will lead to a pick up in demand. It is only going to take a small incremental increase in demand for commodities to send the inflation indexes up. We already had a taste of this before the bubble burst.

A picture is worth a thousand words. You are looking at money stock. Think of it as fuel. Commodity prices should be rising soon--lets say in the second half of the year.

It should be clear from the chart that the Federal Reserve Board has decided that deflation and the current financial crisis are more important that the risk of inflation.

Most forecaster see no inflation problem on the horizon. Many of these same forecasters didn't see a problem in housing. Of course, they failed to add in other components like consumer debt and the unprecedented leveraging of bank and Wall Street balance sheets.

I like to watch stocks like MOO to get a feel about inflation. Gold and MOO are telling a very different story than that being told on television.

By now you may have realized that the more things change the more they stay the same. This unprecedented growth in M2 will lead to a pick up in demand. It is only going to take a small incremental increase in demand for commodities to send the inflation indexes up. We already had a taste of this before the bubble burst.

A picture is worth a thousand words. You are looking at money stock. Think of it as fuel. Commodity prices should be rising soon--lets say in the second half of the year.

Subscribe to:

Posts (Atom)