How to make money in the market...look beyond the obvious...spot the trends...and do your homework.

Thursday, June 27, 2013

Quarterly Survey of Public Pensions for 2013, Stocks, Bonds, Gov and More

Thursday, January 19, 2012

@AllAmerInvest Get Rich, Piracy, Cheaters, Surprise, Nutty Cramer

Online piracy costs U.S. copyright owners and producers billions of dollars every year, but legislation in Congress to block foreign Internet thieves and swindlers has met strong resistance from high-tech companies, spotlighted by Wikipedia’s protest blackout Wednesday, warning of a threat to Internet freedom.

Read More

What the Top 1% of Earners Majored In -- How to Get Rich

We got an interesting question from an academic adviser at a Texas university: could we tell what the top 1 percent of earners majored in?

U.S. Vows to Expand Insider Trading Probe as Fourth Ring Charged

The U.S. government vowed to continue its five-year investigation into insider trading on Wall Street as it charged a fourth ring of hedge-fund traders with using illegal information to make millions of dollars.

All American Investor

Saturday, August 01, 2009

Real National Defense Gross Investment (Chart)

FYI.

Subscribe to All American Investor via Email

Wireless Reading Device

Wireless Reading Device Monday, April 06, 2009

PPIP is on the Rocks -- Public-Private Investment Program for Legacy Assets

In an effort to save the plan, Treasury is making it easier for funds and private investors to participate in its plan to buy up banks' bad assets (PPIP). These rule changes make it clear that interest on the part of large hedge funds is either not big enough, or not wanted.

This should come us no surprise. Asking savvy investors to pay a premium for potentially non-marketable assets goes against the grain of smart investors. Asking hedge fund investors to pay a premium to the market also goes against standard operating procedures at these firms. Other possible hang ups include, the insistence by the Treasury that firms be able to demonstrate the ability to raise $500 million in new capital. And, the limitation that only firms experienced in investing in mortgage backed securities could bid on the distressed assets.

New proposals call for lowering the $10 billion threshold for qualified bidders, and allowing small and women- and minority-owned firms to participate in the plan by partnering with large, qualified, firms. I am scratching my head on this one.

An additional problem could be the current mistrust of the government on the part of financial firms. With the shadow of Congress lurking in the background, investors have to ask themselves--will they change the rules in the middle of the game?

One has to wonder why large hedge funds would want to get involved with the government given the state of affairs in Washington. Funds could be opening themselves to all kinds of problems if they decide to play.

The clearest sign that the plan isn't working is the extension of the deadline to apply by two weeks.

If this plan fails it is likely to lead to a blood bath in the stock market. Investors should recall that the market rallied sharply on both the hints about this plan and after the plan was announced.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Thursday, March 26, 2009

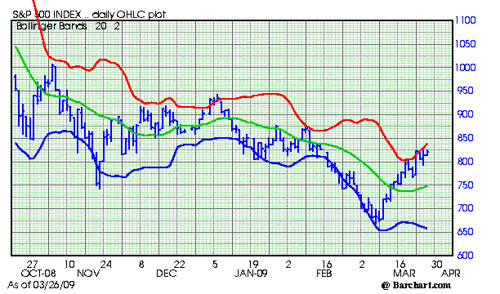

S and P Chart Healthy and Congested

This S and P chart continues to show that technical resilience is building. The S and P is still in a range expansion and this indicates that volatility could pick up at any time. The red line (plus two standard deviations) is sloping up and the market is continuing to hug the line. All short term positives.

The other day we mentioned that there was considerable resistance and congestion in the 825 area. The market continues trying to attack this area. There is more upside potential on a short term basis then we had a few days ago, now up to the 850 area. Good support is down around 750 and is rising.

Bulls should be a bit cautious right now. If the market can't get firmly through 825 soon, the market might be ripe for a further test of the downside to establish support.

Short term still looks good to me.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Wednesday, March 25, 2009

Roubini : RGE Monitor on the the Public Private Investment Program (PPIP)

I received this via email from the RGE Monitor.

I received this via email from the RGE Monitor.The following is a a extract and the complete text is included below.

Bottom line: Will it get credit flowing again?

The immediate market reaction (equities and investment grade CDS staged a substantial rally, less so high yield CDS) was clearly one of relief that nationalization seems to be off the table for now and that the administration is committed to market-based solutions. While the extent of the guarantees almost makes one wonder why the involvement of the private sector is needed in the first place, it is the involvement of the private sector that creates a context in which price setting and discovery happen based on a market mechanism.

An important question at this point is: What should we look at while assessing the plan in the months ahead?

Clearly the unfreeze of credit markets would be the first sign of success but we might not see this happening before some time. Some of the banks that choose to sell assets and take a writedown might be in need of additional capital before they can resume lending. Also, for those institutions that are beyond the stage of rescue and effectively insolvent, the plan will likely not be as effective in stimulating lending or participation in the first place.

The increase in the supply of credit that will come from institutions that are solvent will be important, but will demand be there to do its part? If the real side of the economy continues to deteriorate, it is likely that credit demand might be subdued. Moreover, a further continued deterioration on the real side of the economy would imply new defaults on credit cards, consumer loans, auto loans and mortgages that would result in new toxic assets on the balance sheets of financial institutions recreating an environment where banks would maintain stringent lending standards. Therefore, the success of the plan is a necessary but not sufficient condition to get the economy back on a recovery path. The success of the fiscal stimulus package in sustaining aggregate demand and minimizing job losses and the success in restarting demand in the housing sector will be instrumental to put a stop to the negative feedback loop between the real and the financial side of the economy.

Moreover, if the negative feedback loop persists, need for further funding will arise. While it will be very challenging to obtain Congress approval for additional TARP money, we should point out that the government has set aside an additional $750bn in the FY2010 budget in aid for the financial sector.

Hence, taking care of legacy loans and securities is a welcome step forward, especially for solvent institutions whose asset values are subject to a substantial liquidity discount. However, insolvent institutions might not find as much relief from this plan, and the impact of the plan on the real economy might not be enough to pull the economy out of a contraction for good part of this year and sluggish growth thereafter. But by conducting auctions and determining the market value of the toxic assets, the Treasury will be implicitly using the private sector to ‘stress test’ the financial system to determine which banks are insolvent and therefore will need further government intervention.

Subscribe to All American Investor via Email

The main components of Treasury Secretary Geithner’s new PPIP to price and remove toxic assets from banks’ balance sheets are as follows:

Basic Principles: Treasury will use $75bn - $100bn in TARP money to co-invest alongside private sector participants and the FDIC as well as the Federal Reserve, to buy $500bn to $1 trillion of toxic mortgage assets (both residential and commercial) off banks’ books (‘legacy assets’)

There are two separate approaches for legacy loans and for legacy securities. At first, Treasury will share its $75-100bn equity stake equally between the two programs with the option to shift the bulk of financing towards the option with the greater promise of success with market participants.

1) Public-Private Program for Legacy Loans: The FDIC establishes several public-private investment funds whose sole purpose will be to purchase and hold specific loan pools put up for sale by banks (large and small). The transaction price will be established by the highest bid at an auction run by the FDIC, in which a wide array of institutional investors and even individuals with a long-term orientation are encouraged to participate. The liabilities of the investment fund consist of an equity stake (50% of which provided by auction winner, 50% from Treasury TARP), and collateralized debt issued by the investment fund and guaranteed by the FDIC to finance the remainder of the purchase price (FDIC gets guarantee fee). Before the auction, the FDIC specifies the pool-specific debt-to-equity ratio it is willing to guarantee subject to a maximum 6-to-1 leverage ratio. The private investor would then manage the servicing of the asset pool - using asset managers approved and supervised by the FDIC - until disposal or maturity.

Example: Assuming a 6-to-1 debt-to-equity ratio, the highest bid for a loan pool with $100 face value might turn out to be $84. Of this amount, the FDIC would provide $72 in debt guarantees whereas the equity stake of $12 would be shared equally between the auction winner ($6) and the Treasury ($6).

2) Legacy Securities Program: The legacy securities program is to be incorporated into the Term Asset-Backed Securities Facility (TALF) whose original goal was to provide collateralized financing (non-recourse loans) to buyers of newly created consumer loan/small business loan ABS. Under the Legacy Securities Program, the eligible collateral for TALF is extended to include non-agency RMBS that were originally rated AAA and outstanding CMBS and ABS that are rated AAA.

Example: Under the Legacy Securities Program, up to five Treasury-approved fund managers will have a period of time to raise private capital to target the purchase of designated securities. Assuming the fund manager is able to raise $100 of private capital for the fund, Treasury will provide $100 equity co-investment alongside private investors. Treasury will then provide a $100 loan to the public-private investment fund. Moreover, Treasury may also choose to provide an additional loan of up to $100 to the fund. The investment fund then has $300-$400 at its disposal to buy legacy securities at its discretion. As a purchaser of TALF-eligible securities, the PPIF would also have access to the expanded TALF program of collateralized Fed loans when it is launched.

Assessment

The main sticking points in previous market-based approaches to clear toxic assets from banks’ books were threefold:

a) How to value illiquid assets?

b) Once a transaction price is established, will banks be willing to sell and take a hair cut?

c) How to induce private investors to purchase legacy assets without unduly wasting taxpayer money?

a) Valuation of Illiquid Assets

The theoretical foundations of Geithner’s plan are provided by Lucian Bebchuk from Harvard University among others. He explains that “if the underlying market failure is at least partly one of liquidity, an effective plan for a public-private partnership in buying troubled assets can be designed. The key is to have competition at two levels.First, at the level of buying troubled assets, the government’s program should focus on establishing many competing funds that are privately managed and partly funded with private capital--and not creating one, large "aggregator bank"-- funded with public and private capital and engaging in purchasing troubled assets. Second, several potential fund managers should compete for government capital under a market mechanism resulting in maximum participation of private capital and minimum costs to taxpayers.”

Geithner’s plan seems to follow these guidelines to a large degree. In particular, on the one hand the government subsidy allows private investors to bid a higher price than otherwise warranted (i.e. the government gives investors the equivalent of a call option.) On the other hand, the fact that the private investor is bound to lose its entire equity stake if the asset value deteriorates from artificially high valuations provides an incentive to bid conservatively. Both effects together may contribute to a reasonable level of price discovery. In case of the securities program, the prospect of refinancing purchased legacy securities with TALF via a non-recourse loan (which is the equivalent of a put option) should incentivize private investors to bid higher than otherwise warranted.

b) Will banks participate?

A similar purely private solution to get toxic assets off banks’ balance sheets was tried with Paulson’s aborted Super-SIV when legacy assets were still marked substantially higher than at present. It became clear then that the private sector will require a possibly substantial taxpayer subsidy in order to overcome the collective action paralysis. Indeed, in the case of the legacy loan example outlined in the Geithner plan with a 6/1 leverage, private investors that invest 7.1% (=1/7 * 0.5) of the equity will get 50% of any upside in return. While Treasury will also share in any upside by half, any downside beyond the private investors’ equity stake is clearly borne by the taxpayers.

While this subsidy to investors provides a powerful incentive to bid prices up in a competitive auction, banks stuck with particularly toxic assets or thin capital buffers may still find a potential writedown at market-clearing prices prohibitive and some might need to be recapitalized after taking the hair cut. FDIC Chairman Sheila Bair has already warned that while this plan will help many solvent banks get rid of their toxic assets thus clearing the way for new loans and fresh capital some banks are beyond the stage of rescue. Those borderline insolvent banks will likely require an additional incentive to sell or mandatory participation otherwise they will prefer to hold on to their assets, especially in view of the FASB’s prospective easing of mark-to-market accounting rules.

For the sake completeness, some commentators would also like to see better safeguards established in order to prevent banks and asset managers from potentially colluding in their common interest to the detriment of the taxpayer.

c) And taxpayers?

At the end of the day the performance of the toxic legacy assets is driven by the cash flow performance of the underlying loans. Keep in mind that among subprime borrowers, serious delinquencies and foreclosures have affected about 20% of outstanding loans as of December 2008 thus impairing the cash flow directed to junior RMBS investors and/or ABS CDOs consisting of these junior tranches. While ABX prices responded positively to the prospect of increased buyer interest, the ultimate loan value will depend on whether households and commercial real estate borrowers will continue making payments in the future. More on that below.

As a practical example of the performance of a toxic portfolio, take the Fed’s Maiden Lane portfolio with Bear Stearns assets. Cumberland Advisors reported that so far the results aren’t promising, and they see no prospect for a profit on the assets. In fact, the portfolio has lost over 10% of its value, and losses are mounting. At present, losses on that portfolio exceed $4.5 billion and the taxpayers’ share is now $3.5 billion. Others point to the low recovery value of IndyMac’s mortgage portfolio as a benchmark.

Bottom line: Will it get credit flowing again?

The immediate market reaction (equities and investment grade CDS staged a substantial rally, less so high yield CDS) was clearly one of relief that nationalization seems to be off the table for now and that the administration is committed to market-based solutions. While the extent of the guarantees almost makes one wonder why the involvement of the private sector is needed in the first place, it is the involvement of the private sector that creates a context in which price setting and discovery happen based on a market mechanism.

An important question at this point is: What should we look at while assessing the plan in the months ahead?

Clearly the unfreeze of credit markets would be the first sign of success but we might not see this happening before some time. Some of the banks that choose to sell assets and take a writedown might be in need of additional capital before they can resume lending. Also, for those institutions that are beyond the stage of rescue and effectively insolvent, the plan will likely not be as effective in stimulating lending or participation in the first place.

The increase in the supply of credit that will come from institutions that are solvent will be important, but will demand be there to do its part? If the real side of the economy continues to deteriorate, it is likely that credit demand might be subdued. Moreover, a further continued deterioration on the real side of the economy would imply new defaults on credit cards, consumer loans, auto loans and mortgages that would result in new toxic assets on the balance sheets of financial institutions recreating an environment where banks would maintain stringent lending standards. Therefore, the success of the plan is a necessary but not sufficient condition to get the economy back on a recovery path. The success of the fiscal stimulus package in sustaining aggregate demand and minimizing job losses and the success in restarting demand in the housing sector will be instrumental to put a stop to the negative feedback loop between the real and the financial side of the economy.

Moreover, if the negative feedback loop persists, need for further funding will arise. While it will be very challenging to obtain Congress approval for additional TARP money, we should point out that the government has set aside an additional $750bn in the FY2010 budget in aid for the financial sector.

Hence, taking care of legacy loans and securities is a welcome step forward, especially for solvent institutions whose asset values are subject to a substantial liquidity discount. However, insolvent institutions might not find as much relief from this plan, and the impact of the plan on the real economy might not be enough to pull the economy out of a contraction for good part of this year and sluggish growth thereafter. But by conducting auctions and determining the market value of the toxic assets, the Treasury will be implicitly using the private sector to ‘stress test’ the financial system to determine which banks are insolvent and therefore will need further government intervention.

Contact RGE Sales

Phone: 212.645.0010

E-mail: sales@rgemonitor.com

RGE Monitor | 131 Varick Street, Suite 1005 | New York, New York 10013

Tel: 212.645.0010 | Fax: 212.645.0023

Monday, March 23, 2009

The Public-Private Investment Program for Legacy Assets--Examples and Specifics

Step 1: If a bank has a pool of residential mortgages with $100 face value that it is seeking to divest, the bank would approach the FDIC.

Step 2: The FDIC would determine, according to the above process, that they would be willing to leverage the pool at a 6-to-1 debt-to-equity ratio.

Step 3: The pool would then be auctioned by the FDIC, with several private sector bidders submitting bids. The highest bid from the private sector in this example, $84 would be the winner and would form a Public-Private Investment Fund to purchase the pool of mortgages.

Step 4: Of this $84 purchase price, the FDIC would provide guarantees for $72 of financing, leaving $12 of equity.

Step 5: The Treasury would then provide 50% of the equity funding required on a side-by-side basis with the investor. In this example, Treasury would invest approximately $6, with the private investor contributing $6.

Step 6: The private investor would then manage the servicing of the asset pool and the timing of its disposition on an ongoing basis using asset managers approved and subject to oversight by the FDIC.

Subscribe to All American Investor via Email

The Public-Private Investment Program for Legacy Assets

To address the challenge of legacy assets, Treasury in conjunction with the Federal Deposit Insurance Corporation and the Federal Reserve is announcing the Public-Private Investment Program as part of its efforts to repair balance sheets throughout our financial system and ensure that credit is available to the households and businesses, large and small, that will help drive us toward recovery.

Three Basic Principles: Using $75 to $100 billion in TARP capital and capital from private investors, the Public-Private Investment Program will generate $500 billion in purchasing power to buy legacy assets with the potential to expand to $1 trillion over time. The Public-Private Investment Program will be designed around three basic principles:

* Maximizing the Impact of Each Taxpayer Dollar: First, by using government financing in partnership with the FDIC and Federal Reserve and co-investment with private sector investors, substantial purchasing power will be created, making the most of taxpayer resources.

* Shared Risk and Profits With Private Sector Participants: Second, the Public-Private Investment Program ensures that private sector participants invest alongside the taxpayer, with the private sector investors standing to lose their entire investment in a downside scenario and the taxpayer sharing in profitable returns.

* Private Sector Price Discovery: Third, to reduce the likelihood that the government will overpay for these assets, private sector investors competing with one another will establish the price of the loans and securities purchased under the program.

The Merits of This Approach: This approach is superior to the alternatives of either hoping for banks to gradually work these assets off their books or of the government purchasing the assets directly. Simply hoping for banks to work legacy assets off over time risks prolonging a financial crisis, as in the case of the Japanese experience. But if the government acts alone in directly purchasing legacy assets, taxpayers will take on all the risk of such purchases along with the additional risk that taxpayers will overpay if government employees are setting the price for those assets.

Two Components for Two Types of Assets: The Public-Private Investment Program has two parts, addressing both the legacy loans and legacy securities clogging the balance sheets of financial firms:

* Legacy Loans:The overhang of troubled legacy loans stuck on bank balance sheets has made it difficult for banks to access private markets for new capital and limited their ability to lend.

* Legacy Securities: Secondary markets have become highly illiquid, and are trading at prices below where they would be in normally functioning markets. These securities are held by banks as well as insurance companies, pension funds, mutual funds, and funds held in individual retirement accounts.

If you are having a problem viewing the above illustration join the club. Even in the PDF you have to zoom up to at least 150 percent.

The Legacy Loans Program: To cleanse bank balance sheets of troubled legacy loans and reduce the overhang of uncertainty associated with these assets, the Federal Deposit Insurance Corporation and Treasury are launching a program to attract private capital to purchase eligible legacy loans from participating banks through the provision of FDIC debt guarantees and Treasury equity co-investment. Treasury currently anticipates that approximately half of the TARP resources for legacy assets will be devoted to the Legacy Loans Program, but our approach will allow for flexibility to allocate resources where we see the greatest impact.

* Involving Private Investors to Set Prices: A broad array of investors are expected to participate in the Legacy Loans Program. The participation of individual investors, pension plans, insurance companies and other long-term investors is particularly encouraged. The Legacy Loans Program will facilitate the creation of individual Public-Private Investment Funds which will purchase asset pools on a discrete basis. The program will boost private demand for distressed assets that are currently held by banks and facilitate market-priced sales of troubled assets.

* Using FDIC Expertise to Provide Oversight: The FDIC will provide oversight for the formation, funding, and operation of these new funds that will purchase assets from banks.

* Joint Financing from Treasury, Private Capital and FDIC: Treasury and private capital will provide equity financing and the FDIC will provide a guarantee for debt financing issued by the Public-Private Investment Funds to fund asset purchases. The Treasury will manage its investment on behalf of taxpayers to ensure the public interest is protected. The Treasury intends to provide 50 percent of the equity capital for each fund, but private managers will retain control of asset management subject to rigorous oversight from the FDIC.

* The Process for Purchasing Assets Through The Legacy Loans Program: Purchasing assets in the Legacy Loans Program will occur through the following process:

o Banks Identify the Assets They Wish to Sell: To start the process, banks will decide which assets usually a pool of loans they would like to sell. The FDIC will conduct an analysis to determine the amount of funding it is willing to guarantee. Leverage will not exceed a 6-to-1 debt-to-equity ratio. Assets eligible for purchase will be determined by the participating banks, their primary regulators, the FDIC and Treasury. Financial institutions of all sizes will be eligible to sell assets.

o Pools Are Auctioned Off to the Highest Bidder: The FDIC will conduct an auction for these pools of loans. The highest bidder will have access to the Public-Private Investment Program to fund 50 percent of the equity requirement of their purchase.

o Financing Is Provided Through FDIC Guarantee: If the seller accepts the purchase price, the buyer would receive financing by issuing debt guaranteed by the FDIC. The FDIC-guaranteed debt would be collateralized by the purchased assets and the FDIC would receive a fee in return for its guarantee.

o Private Sector Partners Manage the Assets:Once the assets have been sold, private fund managers will control and manage the assets until final liquidation, subject to strict FDIC oversight.

The Legacy Securities Program: The goal of this program is to restart the market for legacy securities, allowing banks and other financial institutions to free up capital and stimulate the extension of new credit. The resulting process of price discovery will also reduce the uncertainty surrounding the financial institutions holding these securities, potentially enabling them to raise new private capital. The Legacy Securities Program consists of two related parts designed to draw private capital into these markets by providing debt financing from the Federal Reserve under the Term Asset-Backed Securities Loan Facility (TALF) and through matching private capital raised for dedicated funds targeting legacy securities.

- Expanding TALF to Legacy Securities to Bring Private Investors Back into the Market: The Treasury and the Federal Reserve are today announcing their plans to create a lending program that will address the broken markets for securities tied to residential and commercial real estate and consumer credit. The intention is to incorporate this program into the previously announced Term Asset-Backed Securities Facility (TALF).

- Providing Investors Greater Confidence to Purchase Legacy Assets:As with securitizations backed by new originations of consumer and business credit already included in the TALF, we expect that the provision of leverage through this program will give investors greater confidence to purchase these assets, thus increasing market liquidity.

- Funding Purchase of Legacy Securities: Through this new program, non-recourse loans will be made available to investors to fund purchases of legacy securitization assets. Eligible assets are expected to include certain non-agency residential mortgage backed securities (RMBS) that were originally rated AAA and outstanding commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) that are rated AAA.

- Working with Market Participants: Borrowers will need to meet eligibility criteria. Haircuts will be determined at a later date and will reflect the riskiness of the assets provided as collateral. Lending rates, minimum loan sizes, and loan durations have not been determined. These and other terms of the programs will be informed by discussions with market participants. However, the Federal Reserve is working to ensure that the duration of these loans takes into account the duration of the underlying assets.

- Side-by-Side Investment with Qualified Fund Managers: Treasury will approve up to five asset managers with a demonstrated track record of purchasing legacy assets though we may consider adding more depending on the quality of applications received. Managers whose proposals have been approved will have a period of time to raise private capital to target the designated asset classes and will receive matching Treasury funds under the Public-Private Investment Program. Treasury funds will be invested one-for-one on a fully side-by-side basis with these investors.

- Offer of Senior Debt to Leverage More Financing: Asset managers will have the ability, if their investment fund structures meet certain guidelines, to subscribe for senior debt for the Public-Private Investment Fund from the Treasury Department in the amount of 50% of total equity capital of the fund. The Treasury Department will consider requests for senior debt for the fund in the amount of 100% of its total equity capital subject to further restrictions.

Sample Investment Under the Legacy Securities Program

Step 1: Treasury will launch the application process for managers interested in the Legacy Securities Program.

Step 2: A fund manager submits a proposal and is pre-qualified to raise private capital to participate in joint investment programs with Treasury.

Step 3: The Government agrees to provide a one-for-one match for every dollar of private capital that the fund manager raises and to provide fund-level leverage for the proposed Public-Private Investment Fund.

Step 4: The fund manager commences the sales process for the investment fund and is able to raise $100 of private capital for the fund. Treasury provides $100 equity co-investment on a side-by-side basis with private capital and will provide a $100 loan to the Public-Private Investment Fund. Treasury will also consider requests from the fund manager for an additional loan of up to $100 to the fund.

Step 5: As a result, the fund manager has $300 (or, in some cases, up to $400) in total capital and commences a purchase program for targeted securities.

Step 6: The fund manager has full discretion in investment decisions, although it will predominately follow a long-term buy-and-hold strategy. The Public-Private Investment Fund, if the fund manager so determines, would also be eligible to take advantage of the expanded TALF program for legacy securities when it is launched.

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Geithner Speaks: My Plan for Bad Bank Assets

No crisis like this has a simple or single cause, but as a nation we borrowed too much and let our financial system take on irresponsible levels of risk.

However, the financial system as a whole is still working against recovery. Many banks, still burdened by bad lending decisions, are holding back on providing credit. Market prices for many assets held by financial institutions -- so-called legacy assets -- are either uncertain or depressed. With these pressures at work on bank balance sheets, credit remains a scarce commodity, and credit that is available carries a high cost for borrowers.

Our new Public-Private Investment Program will set up funds to provide a market for the legacy loans and securities that currently burden the financial system.The funds established under this program will have three essential design features.

- First, they will use government resources in the form of capital from the Treasury, and financing from the FDIC and Federal Reserve, to mobilize capital from private investors.

- Second, the Public-Private Investment Program will ensure that private-sector participants share the risks alongside the taxpayer, and that the taxpayer shares in the profits from these investments.

- Third, private-sector purchasers will establish the value of the loans and securities purchased under the program, which will protect the government from overpaying for these assets.

Our goal must be a stronger system that can provide the credit necessary for recovery, and that also ensures that we never find ourselves in this type of financial crisis again. We are moving quickly to achieve those goals, and we will keep at it until we have done so.Read the entire Geithner statement.

Subscribe to All American Investor via Email

Tuesday, March 17, 2009

IRS: Dumb, Tough Luck, Madoff Investor, Write it All Off

You and me? If we have a big capital loss in the stock market we can write off $3,000 a year--until the cows come home--against our taxes.

Madoff victim? You can write off up to 95 percent of what you invested with Madoff, plus investment income you thought you had earned. Thought you had earned?

Before I forget, the Internal Revenue Service says this applies to anyone that is a victim of a Ponzi Scheme.

AIG? Bear Stearns? Lehman Brothers?

Subscribe to All American Investor via Email

WASHINGTON (Reuters) - The Internal Revenue Service issued new rules on Tuesday that would allow victims of Ponzi schemes like the one run by Bernard Madoff to recoup some money by claiming theft losses on their tax returns for 2008.

Investors in Madoff's scheme would theoretically have been paying capital gains taxes on the profits they made from his investment. Since those profits turned out to be phony, the IRS said investors should be entitled to a refund of those taxes.

As theft losses, investors are entitled to a much larger deduction than the normal "capital loss" deduction, which is typically capped at $3,000 per year.

Under the new rules, victims would be able to take a deduction of as much as 95 percent of the amount they invested, plus investment income they thought they had earned, subtracted from any money given back to them by the government's insurance program, the Securities Investor Protection Corporation.

The new rules were announced by IRS Commissioner Douglas Shulman in testimony to the Senate Finance Committee.

"It is unfortunate in these otherwise difficult economic times that we are here today to discuss a situation where thousands of taxpayers have been victimized by dozens of fraudulent investment schemes," Shulman told the committee.

Bernard Madoff, 70, was jailed on Thursday after pleading guilty to running the biggest investment fraud in Wall Street history that drew in as much as $65 billion over 20 years.

His sentencing on 11 criminal charges is scheduled for June 16, when he could be imprisoned for the rest of his life.

Shulman underlined that the new rules are not specific to Madoff and would apply to any victim of a Ponzi scheme.

(Reporting by Corbett B. Daly, editing by Anthony Boadle)

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

Monday, March 09, 2009

Chart S an P 500 Support 652 and dropping--March 9

Support continues to decline and is now around the 652 area. Price drops more than one percent below this level should find good support today.

There is good news as the momentum behind the downside thrust is slowing. However, the market is still subject to a potential downside market capitulation at any time. A hard downside thrust, or continued slow deterioration is likely to trigger mutual fund selling.

Many forecasters are calling for a low around the S and P 500, 600 level. This almost seems like a self fulfilling prophesy coming to fruition. Maybe, maybe not.

Source: Barchart.com

Subscribe to All American Investor via Email

Follow us on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Sunday, March 08, 2009

Reserve Balances held by the Federal Reserve Bank are going off the chart

The the U.S. monetary base has increased from approximately $890 billion to $1,740 billion--doubling in a little more than 3 months. This is unprecedented and is represented by the blue line climbing straight up the right side of the chart.

Right now, there is little concern about inflation. However, there should be concern because if markets do not become normalized soon, the Fed will not be able to sell these distressed assets without taking enormous losses. If the Fed is unable to unwind these assets in an orderly fashion then inflation will almost certainly come back with a vengeance.

Gold, oil, and commodity prices should be watched very closely by investors. Even a slight pick up in demand is likely to send commodity price up sharply. Weather factors could also be a factor in the major growing regions of the United States this year--right now it is very dry, not a good condition.

Rises in the monetary base often lead to rises in inflation. The current increase in the monetary base started in the later part of 2007; and then took off with a vengeance in September 2008. There is usually a 12-18 month lag before inflation hits. We are coming into the window right now.

Subscribe to All American Investor via EmailFollow us on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Saturday, March 07, 2009

S and P Monthly Chart indicates a sharp rally is coming soon

Subscribe to All American Investor via EmailEach bar on the chart above represents one month. Since the high in September, 2008 the S and P 500 has closed lower five times and higher once (December).

You can see the slope of the market is very severe. This cannot be sustained much longer. When a market index trades down at a sharp angle like the one above, the market always rallies sharply when it reverses directions. This rally could start at any time.

The bad news is that the market could go as low as 565 on the S and P 500 before the rally starts. This is the extreme case, and would only happen in a severe occurrence of a market capitulation. Given the current political and economic climate you have to believe that anything is possible. Unlikely yes, possible, yes.

For those holding cash, any hard down opening is likely to present an opportunity to buy high quality stocks at low low prices. We could see mutual funds, institutional investors, and retail investors all selling to raise cash or exit the market at any time. This is a likely scenario.

I will be monitoring this possible market capitulation around midnight and 7 AM each day. You are welcome to come here and check for a possible market capitulation alert. You are also welcome to subscribe via email, feed reader, or Twitter to get the updates.

I explained how to play a market capitulation in a previous article--Market Capitulation Means Big Opportunity to Make Money. This article contains additional information about market capitulations and how to place your orders into the market.

Follow us on Twitter

More from All American Investor

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Six Errors on the Path to the Financial Crisis

- Who Caused the Financial Crisis?

- Option ARM--The Toxic Mortgage

- Debt Binge--The Perfect Financial Storm

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Tuesday, September 16, 2008

Financial Meltdown--Where there is Smoke, there is Fire

At dinner he described the situation to me. He said, “Where there is smoke there is fire”. He went on to explain that any time a major financial institution gets in trouble you could draw a circle around its location and expect the problem to spread to any other financial institution in a 150 mile radius (keep in mind this was the 1980s and before the Internet). He went on to explain the interconnectivity of financial institutions in a geographic proximity....His trip and fact finding mission convinced him that there was going to be a real financial crisis in Texas and that it would likely devastate the major banks and savings and loans in the region. This was a very unpopular stance that cost him his job....It also was the catalyst of a stock market crash in 1987....I am reminded of other sayings that I heard early in my career on Wall Street—“never try and catch a falling knife”. I find myself thinking right now—“Cash is King”.

Financial Meltdown--Where there is Smoke, there is Fire

Back in the 1980s I learned an important lesson. At the time, I was with Bear Stearns and working in their Dallas, Texas office. The head of credit came to Texas, from New York, to visit the state’s major banks and Savings and Loans. He was there to discuss their financial statements. Specifically, he was trying to get a handle on their financial viability and credit risk. There was a growing concern about the quality of credit and soundness of financial institutions in the southwest and California. The head of credit spent a couple of days in Dallas and Houston talking to the CFOs of these banks. Late in day, at the end of the trip, I saw him sitting alone in the office and asked him what he was doing. He informed me he was done but was not scheduled to fly out until the next morning. I saw this as an opportunity to “pick” his brain and learn something. So, I invited him out to dinner.

At dinner he described the situation to me. He said, “Where there is smoke there is fire”. He went on to explain that any time a major financial institution gets in trouble you could draw a circle around its location and expect the problem to spread to any other financial institution in a 150 mile radius (keep in mind this was the 1980s and before the Internet). He went on to explain the interconnectivity of financial institution in a geographic proximity. His trip and fact finding mission convinced him that there was going to be a real financial crisis in Texas and that it would likely devastate the major banks and savings and loans in the region. This was a very unpopular stance that cost him his job. At the end of the day he was right. Both of the major banks in Dallas failed (Republic and First Interstate) and all of the major S and L’s in Texas failed (Sunbelt and Bright Bank to name two). This resulted in the formation of the Resolution Trust Corporation, a government agency set up to dispose of the massive amount of defaulted loans owned by these financial institutions. It also was the catalyst of a stock market crash in 1987.

For years I have been telling my friends that the derivatives and swaps markets would turn out to be the equivalent of the savings and loan fiasco but on a scale that could never be imagined. Let me ask you, do you know anyone that predicted that Bear Stearns, Lehman Brothers and AIG would go up in smoke? That Merrill Lynch would be offered at a fire sale? Have you heard prior discussions about the interconnectivity of all these financial institutions? Are they within a 150 mile radius?

AIG, the next to go, is a good example of the direness of the current situation. AIG has been racking up enormous profits for a very long time. Just last week they were considered to be solvent. They are loaded with cash. They are claiming $1,000,000,000,000 in assets (Trillion). They operate world wide. If you ask, AIG will tell you their problem is not a solvency issue it’s a liquidity issue. It seems that the financial community is no longer buying this argument and no one is willing to stand up and throw money at the problem. AIG does not have the necessary assets to collateralize the $75 billion in loans it needs right now to keep operating. If they go down someone will be on the hook for the insurance side of the business. I bet you thought as an insurance company there were being regulated. Partially true, but this does not include the part of the business that is all wrapped up in the credit default swaps market and other derivatives designed to leverage the balance sheet and create “monster” profits. It appears the Fed and government regulators have finally decided that bailouts aren’t working and decided to say no to Lehman and AIG. Lehman is bankrupt and it appears that AIG will declare bankruptcy soon. The too big fail rule is no longer in effect.

It would be foolish to believe that once AIG goes over the cliff it will bring an end to the financial crisis we are seeing today. You should be thinking of the interconnectivity of AIG, and all the counterparties that are doing business with AIG worldwide. Companies doing business with them will get wounded, maybe mortally wounded. What looked like a US problem is now a global problem. This will spill into financial markets world wide.

It appears it is finally being recognized that this is not smoke, it’s a FIRE. It appears that “too big to fail” is no longer a workable strategy to fix the problem. It appears the reality of the credit swaps derivatives market is finally being recognized. It’s likely that much of this paper is worthless or only worth cents on the dollar. This financial crisis is not likely to go away over night. There is more to come before all this “paper” can get unwound or find a home. In the interim there is an enormous risk in the stock and other financial markets.

The Fed will address this issue by adding massive liquidity to the markets. The world’s central banks will do the same. It is the right thing to do. But, it is a short term fix that is like prescribing an aspirin for a major infection. It might lower your fever but it won’t cure your illness.

In closing, I am reminded of other sayings that I heard early in my career on Wall Street—“never try and catch a falling knife”. But, right now I find myself thinking—“Cash is King”.

Wednesday, May 16, 2007

Are alternative-energy stocks the new tech?

Are alternative-energy stocks the new tech stocks, or are they simply socially responsible stocks and funds in disguise?

Are alternative-energy stocks the new tech stocks, or are they simply socially responsible stocks and funds in disguise?