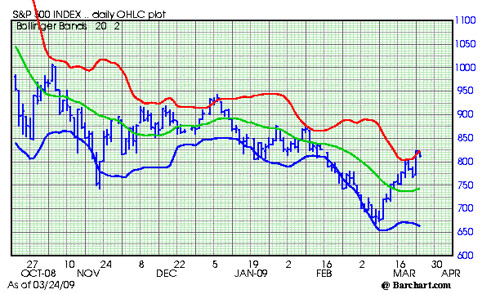

If you take a good look at the chart you will notice that the S and P bounced off the red line on March 18, 19. The red line should be considered resistance, and trades over that line are often met with resistance. The red line is the two standard deviation barrier.

Once again, we are bouncing off the line. So today looks like a day of rest. The red line is now sloping up fast, and short term we are in a range expansion. The market will have additional upside potential in the days ahead. However, if you look across the chart, all the way back to October, you will notice there is a lot of congestion in the 825 area.

Sooner or later, the market will back up and test some lower resistance. This is when the market will prove itself or fail. I understand that people are anxious to get their money back. However, since the bottom occurred, the market has not had a correction or any serious test of prices on the down side.

To become a comfortable bull, it is necessary to see the market probe lower levels and hold. Once good support areas can be identified, it is much easier for traders to add support to the market by buying againsst those support levels.

It is too early to tell if this is a correction in a bear market, or the turn in the market. The market still needs to prove on drops that there are buyers in waiting.

It is a good time to be patient. The market does look good on a short term basis right now.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter

No comments:

Post a Comment