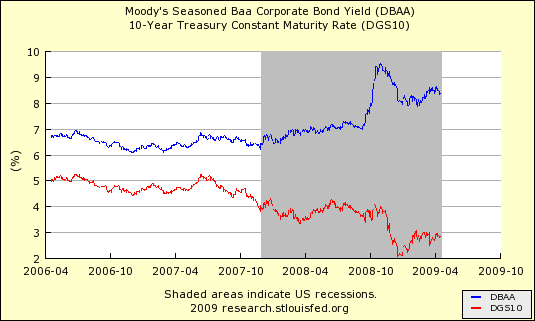

In 2007, the spread was running around 175 basis point. It is now in the 550 basis points area.

Corporate Baa--blue line. 10 Year Treasury--red line.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

More from All American Investor

- 30 Year Conventional Mortgage Rate (Chart)

- Top Hedge Fund Managers Make Billions in 2008

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Option ARM--The Toxic Mortgage

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Follow All American Investor on Twitter

No comments:

Post a Comment