This is one of the better articles I have read on the stress test--

Stress Test for Banks Exposes Rift on Wall St. It has me thinking about the long term direction of the stock market.

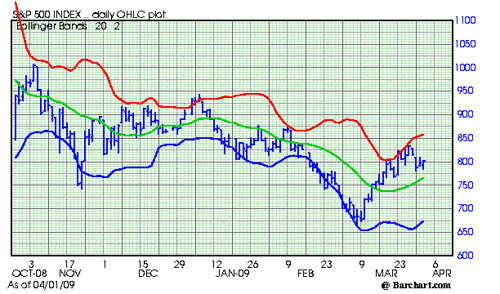

I think if you read this article carefully you might conclude that much of what is being written about banks is getting discounted in the stock market. I am not saying everything is beautiful. Quite the contrary, we are teetering on the brink of disaster. But, I find myself asking myself constantly--has the market discounted the news. It is always hard when things look bleak to see the light at the end of the tunnel. However, the market always discounts the future long before the future gets here. The market always bottoms when things look bleakest to the herd. The herd tends to focus on the recent past, rarely looking forward into the future.

I am reminding myself that back in 1990-91 Ross Perot was shorting Citibank stock. If you had bought the stock back then you could have made more than 30 times your money by 2006.

At the time of the 1991 recession there were many that felt the banks were going to go broke. Remember, we were just coming through the S and L Crisis and the failure of some major banks in the southwest. The stock market had crashed in 1987 and we were entering a recession. The time really looked bleak. Most investors had thrown in the towel and were focusing on the past.

If you are old enough, you might remember that from 1966 to 1982 the market traded in a broad trading range that was capped by Dow 1060. Up and down, up and down, The Dow did crash down to the 550 area in 1973, and the 750 area in 1980.

Most of you are too young to remember that the S an P 500 traded around 102 in 1973 and again in 1982 (you read that right 102). It turned out that August, 1982 was the bottom of a long term consolidation and the beginning of the bull market. The Dow crashed through the ceiling and the market soared.

I am starting to believe we are nearing a major low in the market. So put me down the way I have been for some time--long term bullish, short term bearish. Not quite ready to the jump all the way into the pool. It is a good time to stick your foot in the water and check the temperature.

These hot flash day rallies in this stock market downturn are not making me feel like I am missing out on anything. I do find it amusing that every time we have a nice up day the talking heads on television get all excited and start talking bull market.

The market rarely goes up or down in a straight line. The rallies right now are for suckers who think every tiny piece of news is what is going to make the market go up or down long term. Each piece of news is like a piece of the puzzle. It is not the puzzle.

These hot interpretations of every little blip on the news screen makes the market go up and down like a yo-yo. But, it is the long term trend of the market that is most important; and, the big picture fundamentals set the stage for the big big moves. You make the big bucks by spotting the long term trends and being patient once they get underway.

I'll leave with two things. First, read the article about stress testing banks--to me this is a good thing and might be an event that could put in the bottom for the stock market. I am thinking we could be in for a 20-30 percent rally soon. Second, the major trend of the stock market is still down--so it is very risky to have the boat loaded. Foot in the water--good, water up to your neck--not good. Chicken on hill, maybe.

Subscribe to All American Investor via Email

Stress Test for Banks Exposes Rift on Wall St

The New York Times

By ERIC DASH

Big banks keep insisting that they have all the capital they need — a claim that might strike many people as absurd at a time the government is spending billions of taxpayer dollars to prop up the financial industry.

So here is a surprise: By some common measures, the banks do have enough capital.

The problem is, it is not the kind of capital investors think the banks need.

For years, the question of what constitutes a bank’s capital, and how to measure it, was largely academic. But the issue is coming to the fore as federal regulators start administering a tough new “stress test” to 20 large banks on Wednesday to determine how the banks would withstand a severe economic downturn.

Investors in the stock market and the banks are increasingly at odds over how to assess the health of financial institutions. Where regulators side could determine the fate of many lenders, particularly big banks like Citigroup and Bank of America, whose share prices have plummeted this year on fears the government will increase its ownership of them.

Until the financial system deteriorated last fall, investors focused on what is known as Tier 1 capital, which consists of common stock, preferred stock and hybrid debt-equity instruments.

Now, however, they are focusing on what is called tangible equity capital, which includes only common stock, saying it is a better way to measure the risk in bank shares.

The difference might sound like something only an accountant would worry about, but it lies at the heart of two questions confounding both Washington and Wall Street: Are the nation’s banks sound? And are bank shares a good barometer for the health of the financial system?

Sheila C. Bair, the head of the Federal Insurance Deposit Corporation, said on Tuesday that the nation’s banking industry was safe. “All these large banks exceed regulatory standards for being well capitalized, so for right now, they’re fine,” Ms. Bair said on CBS television’s “The Early Show.”

“I think the big issue is how much of an additional buffer they have to withstand more adverse economic situations and that’s something we’re going to try to figure out with a stress test.”

But Citigroup, which maintains that it is well capitalized by its regulators’ standards, was nonetheless locked in negotiations with the government on Tuesday over a third rescue. Under the plan, the government is expected to raise its stake in Citigroup to 30 to 40 percent, from about 8 percent now. The deal, which was moving toward completion and could be announced as early as Wednesday, would bolster the level of common stock that investors are focused on.

At Bank of America, Kenneth D. Lewis, the chief executive, assured the bank’s employees on Monday that Bank of America has enough capital, including common stock. “I have said repeatedly that our company does not need further assistance today and I don’t believe we’ll need any more in the future,” Mr. Lewis wrote in a memorandum.

Like regulators, investors are struggling to determine how much additional capital banks might require if the recession deepens and unemployment rises, developments that would almost certainly lead to new, heavy losses at banks.

Institutions that fail the stress test will be required to raise new capital, probably through more money from the government.

Beaten-down financial shares rallied on Tuesday after Ben S. Bernanke, the chairman of the Federal Reserve, seemed to rebuff suggestions that banks might be nationalized outright. Even so, Mr. Bernanke offered a sober assessment of the economy to Congress on Tuesday.

Details of the bank stress test are scant, but federal regulators are expected to examine the ability of banks to cope with a situation in which unemployment rose to 10 to 12 percent and home prices declined by an additional 20 percent, according to Treasury Department and Federal Reserve officials. While officials say they don’t expect such a severe downturn, some economists aren’t ruling one out.

In recent weeks, federal regulators were planning to continue to demand that banks maintain Tier 1 capital equivalent of at least 6 percent of total assets adjusted for risk. Regulators also want at least half of it in common stock, but have given banks some leeway.

On Monday, the federal banking regulators issued a statement saying that if the stress test indicated an “additional capital buffer” was necessary for some institutions, it “did not imply a new capital standard and is not expected to be maintained.”

But stock investors are homing in on tangible common equity. Whereas Tier 1 capital gives regulators comfort because it captures a bank’s ability to weather a financial storm, stock investors, who suffer the first losses, are worried about their own exposure. Tangible common equity, or T.C.E., they argue, is the best measure for them.

Until last fall, there was little difference between the two measures. But when the government made big investments of preferred stock to shore up banks, common shareholders became more vulnerable.

John McDonald, an analyst at Sanford C. Bernstein & Company, compared the move to an army reinforcing its troops from the back. “Any reinforcements improve the chances of winning the battle,” he said. But if you are a stockholder, “you are still the guy taking the first hit on the front line.”

Regulators worry that banks’ depositors and trading partners might interpret more bad news for banks — including a continued decline in share prices — as a sign confidence is flagging. As a result, regulators, too, are focusing more on tangible equity.

“If our banking system looks frail and hobbled, we care since there could be a loss of confidence” Mr. McDonald said. “But the stock price may very well not be a reflection of the broader risk.”

Louise Story contributed reporting.

More from All American Investor

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments.

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments.