Technical

Monday Morning Chartology

On Friday, the S&P rebounded back above its 50 day moving average and the uptrend off the June lows---negating the breaks of these support levels. Notice that it is in a narrowing pennant formation, the upper boundary of which is the downtrend off the April high and the lower boundary of which is the uptrend off the June low. The technical axiom is that whichever of these boundaries are ultimately broken defines future Market direction, that is, if the S&P breaks above the downtrend off the April high, the trend will be to the upside.

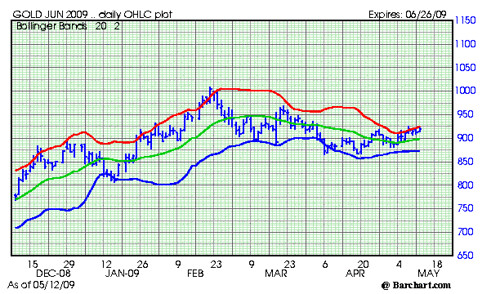

The GLD chart doesn’t inspire a lot of confidence, with an extended series of lower highs. Nonetheless, it has held the lower boundary of its intermediate term trading range; and until that breaks, our Portfolios will continue to hold their positions.

The VIX (16.7) remains above the lower boundary of its intermediate term trading range (15.4). The head and shoulders formation continues to develop and if the VIX breaks below that level, the trend will be re-set to down and that will be a positive for stocks.

Fundamental

Does QE really work (medium):

http://www.zerohedge.com/news/does-qe-really-work-evidence-date

ECB alters its stance on bank senior debt impairment (medium):

http://www.zerohedge.com/news/shocking-development-ecb-demands-impairment-senior-spanish-bondholders-eurocrats-resist

Economics

This Week’s Data

June retail sales came in down 0.5% versus expectations of up 0.2%; ex auto, sales were down 0.2% versus estimates of up 0.1%.

The July New York Fed manufacturing survey was reported at 7.39 versus forecasts of 5.0

Politics

Domestic

Obama on success (short): Read it and weep

http://www.zerohedge.com/news/president-obama-if-youve-got-business-you-didnt-build-someboy-else-made-happen

More shenanigans from the political class (short):

http://dailycaller.com/2012/07/13/will-obama-get-away-with-it/

An ode to Ken Salazar (medium):

http://michellemalkin.com/2012/07/13/obamas-interior-department-still-going-rogue/

Steve Cook received his education in investments from Harvard, where he earned an MBA, New York University, where he did post graduate work in economics and financial analysis and the CFA Institute, where he earned the Chartered Financial Analysts designation in 1973. His 40 years of investment experience includes institutional portfolio management at Scudder, Stevens and Clark and Bear Stearns. Steve's goal at Strategic Stock Investments is to help other investors build wealth and benefit from the investing lessons he learned the hard way.